Automation Expectations: Discrete Manufacturing

Few would argue that 2020 was a year in which our collective and individual visions of the present and future were not profoundly impacted. In light of this, several studies were conducted over the course of the year to obtain end user input on the effects of COVID-19 on industrial manufacturing and processing operations.

To provide a broader view, Automation World conducted a study in late 2020 of automation technology suppliers. We asked those suppliers an array of questions to better understand how they saw their customers—end users across the industrial spectrum—reacting to the economic and societal changes of 2020.

The results of this survey will appear in four feature article installments in 2021. The first of which is this article, exploring how the marketplace realities of 2020 are—or are not—influencing the direction of automation use in the discrete manufacturing sectors. Following articles will look at trends in batch manufacturing and continuous processing, with the final article comparing trends across all three verticals.

Spending forecasts

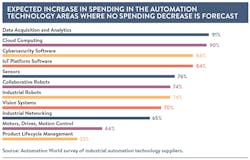

The survey asked technology suppliers for feedback on how they gauged planned spending (based on activity with their end user customers) across more than 20 key industrial automation technology areas. Eleven of these technologies showed no signs of slowing (i.e., 0% of respondents expect to see a decrease in spending) into 2021. Those technologies, along with the percentage of respondents’ projecting increases in spending in 2021 are:

- cloud computing (90%)

- collaborative robots (74%)

- cybersecurity software (84%)

- data acquisition and analytics (91%)

- industrial networking (65%)

- industrial robots (74%)

- IoT platform software (84%)

- motors, drives, motion control (44%)

- product lifecycle management (33%)

- sensors (76%)

- vision systems (70%)

The technologies around which respondents expect to see decreased spending in 2021 are: augmented reality, controllers, edge computing, ERP (enterprise resources planning), HMI/SCADA (human machine interface/supervisory control and data acquisition), I/O (input/output), MES/MOM (manufacturing execution systems/manufacturing operations management), remote access/monitoring, and simulation/digital twin. However, expected spending decreases for these technologies are not significant. Six percent of respondents forecast a decrease in ERP spending, with all the rest indicating only 3% of respondents expect a decrease in spending.

Given these results, planned spending on automation looks to remain stable into the next year, with significant spikes expected for data acquisition and analytics, cloud computing, cybersecurity software, IoT platform software, and sensors.

Digital transformation: delayed or sped up?

“The number one concern I hear from mid-market manufacturers today, aside from sales, is labor, including cost, skills, and availability,” observed Steve Bieszczat, chief marketing officer for Dassault Systèmes’ DelmiaWorks. “I would single that out as today’s digital transformation bottleneck.”

These labor factors are so impactful to small and mid-sized manufacturers because these manufacturers “don’t fit the mold of the highly automated manufacturing processes we envision when we think of a modern factory—with teams of synchronized robots welding a car frame together in one continuously orchestrated movement,” explained Bieszczat. “Instead mid-market manufacturers are built to be flexible. Produce 10,000 hub caps, and then stop and make 1,000 swimming pool ladders, and so on. That agility and flexibility are their core values, but this defeats total automation. If you’re going to change your job mix every day, you need people, and you need to be good at doing changeovers. Human labor is notoriously flexible. So, rather than complete automation, we’re seeing digital transformation take the form of having a connected, directed worker at each work center.”

Bieszcczat’s observation that the digital transformation is more about connecting and directing workers than it is about delivering widespread lights-out factories was echoed by Josh Eastburn, director of technical marketing at Opto 22. “Increased productivity and reduced costs remain strong financial motivators for these [digital transformation] investments. In the short term, customers are seeking ways to maintain pace in spite of current economic pressures,” he said. “However, they are doing it with a long-term vision of developing data-centric infrastructure that generates insights into potential process improvements, increases in operating equipment effectiveness (OEE), and better maintenance of machines.”

This perspective on the digital transformation—that it’s more about gathering and analyzing data to optimize industrial work than it is about constructing a highly futuristic factory—is a key realization in terms of how industrial digitization should be properly viewed. Recognizing that the ideas behind Industry 4.0 and the Internet of Things are aimed at realistic, achievable improvements enabled by new levels of connectivity and insights helps smaller manufacturers understand that digital transformation is not something solely reserved for the largest players in industry. Instead, it is the means through which manufacturers can get a better handle on the labor and operational issues that drive their day-to-day activities and decision making. This realization can be even more impactful for small and mid-sized manufacturers given that making the digital transformation does not require a big bang type of rollout. In fact, most technology suppliers advise manufacturers, regardless of their size, to approach the digital transformation in bite-sized chunks to better assess and adapt their approach based on achieved results as well as real and projected returns on investment.

Bieszczat said, “Today, in most parts of the country, the pool of available hourly manufacturing workers is stagnating. Immigration has slowed, many workers are choosing service and distribution jobs over manufacturing jobs, and some people are just removing themselves from the work force. Higher pay would draw people back into manufacturing, but the business model the mid-market is fighting to maintain is built around $16-per-hour workers. Manufacturers fight to maintain that business model because higher wages tend to push business offshore.”

He said this business model “brings us back to digital transformation and the concept of orchestration, which started with MRP (materials requirements planning)—to orchestrate materials, and progressed on to ERP—orchestrating end-to-end manufacturing operations, and to MES —orchestration at the work center.” Bieszczat explained that’s why the concept of the connected and directed worker is becoming so popular. “The idea is to create digital work center consoles that guide, record, and inform the worker so they can quickly step into a work center, know what to do and how to do it, and take whatever manual actions might be necessary to complete a particular production run. With the rapid turnover in job mix and in the hourly labor performing these jobs, the ability to quickly and digitally direct a worker to take the exact steps related to a particular job creates faster changeovers, requires less training, and significantly increases labor flexibility.”

Eastburn noted that, generally, labor reduction and retasking aren’t “a direct part of our customers’ project goals, but we expect it to be an outcome of the resulting process improvements. Likewise, we expect these kinds of technology investments to increase the appeal of the manufacturing industry for incoming generations of automation professionals.”

COVID-19 effects

Responses to the survey indicated that the biggest boost COVID-19 delivered for automation technologies was for remote access.

Bill Dehner, automation specialist at AutomationDirect, said “Health risk to employees and unpredictable lockdowns are factors that weigh heavily on a production facility during a pandemic. The remote visibility provided by IoT (Internet of Things), cloud computing, and associated technologies allows facilities to operate with a skeleton crew if needed to ensure minimal risk to employees and continue production during lockdown conditions.”

Opto 22’s Eastburn added, “With the shift to remote work, there is a renewed emphasis on remote connectivity to equipment with a keen focus on cybersecurity, without which some equipment is no longer securely accessible. Applications indirectly sustaining manufacturing during the pandemic, like contact tracing and workplace hygiene, are also triggering some new investment [in automation technologies].

“The challenges brought by COVID-19 have created a newfound appreciation for the role of ERP in business continuity,” noted DelmiaWorks’ Bieszczat. “Many of our customers have been adding modules or seats to manage remote workers and spikes in demand, particularly in medical products, consumer goods, and packaging.”

According to Bieszczat, some of this is “certainly related to COVID-19 social distancing, but the longer-term trend is the attractiveness of jobs in the service sector over those in manufacturing. Manufacturers’ only real choice for attracting and retaining the workforce they need is to pay more and offer more compelling work environments. Digital transformation has two immediate impacts: It automates previously manual tasks and it eliminates some of the more mundane work on the shop floor. The result is lower labor costs and a more interesting or challenging working environment.”

Bieszczat also noted that “we’re seeing manufacturers use a combination of ERP and MES to minimize their onsite shop floor staff by precisely scheduling work; dispositioning materials; and monitoring equipment for output, quality, and maintenance issues in real time. In other words, manufacturers are managing the shop floor by exception rather than rote supervision. Those employees who can work remotely have been accessing their ERP systems from their mobile phones or tablets to, for instance, track which jobs are running, determine the inventory stock on hand, or check on order status and completion progress within seconds.”

He also noted that DelmiaWorks has seen the term “rapid” take on new meaning in the wake of COVID-19. “Whether responding to rapid changes in market demand or shifts in the supply chain, manufacturers have relied on real-time data to quickly make informed decisions,” said Bieszczat. “Real-time process and production monitoring have been instrumental in giving manufacturers insights into capacity that have allowed them to take on additional business, as well as identify potential issues before they affect product quality or delivery times. Manufacturers are also using real-time production monitoring in combination with MES and quality management software to run lights-out manufacturing shifts.”

Obsolescence

Several respondents to our survey indicated that the approaching obsolescence of installed technologies is driving the discrete manufacturing industry’s interest in advanced, IoT-related technologies. Based on the responses we received, we wondered if those making significant automation investments are doing so not just to replace existing technologies, but to leapfrog ahead of their competition.

John Gaddum, U.S. service sales manager at Bosch Rexroth, said the trend in today’s environment of uncertainty is to look at applying IoT technologies wherever applicable to provide more transparency to existing, aging equipment to meet the operational efficiencies or goals set by production. “For example, many of our customers are holding back on large capital expenditures, such as new equipment, and looking at maximizing profits, with as little investment as possible, in order to collect data from existing equipment. The equipment may have been installed 20 to 30 years ago and was not designed with the current IoT technologies available today. The additions of a single gateway often can meet most of the needs, yet the customer can do this with as little as a couple thousand dollars versus upwards of a million or more.”

He explained that these connectivity technologies are often focused on data analysis for production purposes, such as improvements surrounding OEE practices or providing predictive maintenance capabilities with the goal of improving the operational efficiency of aging equipment. “The benefits, which were non-existent on the equipment approaching obsolescence, can make a big impact on operational efficiencies and, in turn, the company’s profitability.”

Opto 22’s Eastburn added: “The goal is to aggregate operations technology (OT) data, combine it with data from other sources, and transport it into supporting systems, regardless of the age of the technology. Existing technologies are mature and functional, so often it isn’t worth the risk or expense to modify code or upgrade hardware directly. It’s easier to layer on newer, connected devices that can harvest the data from old and new systems alike.”

DelmiaWorks’ Bieszczat explained that, over the last few years, he’s seen an uptick in manufacturers investing in upgrading their existing machinery with IoT sensors or buying new smart, connected machines. “More recently, there’s been a bigger push to buy new, smart equipment. The driver for this can be as simple as monitoring the number of cycles on a machine and predicting maintenance needs rather than having maintenance staff walk the floor looking for machine issues,” he said. “Or, it can be part of a more complex digital transformation, like measuring critical dimensions with digital scanning devices and alerting for issues through statistic process control-type process monitoring intelligence.”

About the Author

David Greenfield, editor in chief

Editor in Chief

Leaders relevant to this article: