Lower Prices Push Oil and Gas Industry to Further Standardization, Big Data

As consumers, we might be dancing around the gas pumps with a few extra dollars in our pockets. But the latest news from the world’s oil majors has not been so happy as they struggle with drastically curtailed earnings in the face of continuing cuts in oil prices.

Within the past couple weeks, the big players have been reporting about their fourth-quarter woes: Chevron saw its first quarterly loss since 2002; BP had a loss of $3.3 billion; ConocoPhillips a loss of $3.5 billion and a revenue drop of 42 percent; ExxonMobil’s profits dropped 58 percent; and Shell’s profits fell 56 percent.

Along with these reports have come decisions to cut back on capital expenditures. ConocoPhillips, for example, lowered the value of its oil properties and exploration assets by $2.2 billion. BP plans to sell $3 billion to $5 billion of assets over the next two years. Shell has abandoned its Arctic development plans, and will also postpone two major projects: a liquefied natural gas (LNG) operation in Canada and a deepwater oil and gas project off the coast of Nigeria.

In a recent benchmark study of the oil and gas industry commissioned by industry advisor DNG VL, nearly three-quarters of those surveyed said they were preparing their companies for a sustained period of low oil prices; 42 percent of them do not expect to see oil prices increase this year.

The ramifications of that include, of course, considerable cost cutting. More than half of the respondents said their companies’ capital investments would decline in 2016, particularly in upstream activities. Operating expenditures will also decline—55 percent of respondents said their opex would decrease this year, a number that rises to 65 percent in upstream oil and gas. Cutting headcount is a common response, with 31 percent saying that their companies would prioritize reducing the labor force as a way to control costs.

“Many companies are handling this downturn in exactly the same way as they did the previous one: They are laying off lots of people, stopping projects, and significantly cutting back on research and development,” said Graham Bennett, vice president of DNV GL, for the report. “The operators can weather the low oil price storm for some time, but the supply chain will suffer far more, and there is a risk of a permanent loss of capacity in the supply chain if low prices persist.”

Efficiency, standardization

Arguably a longer-term approach focuses on increasing efficiencies. Michael Utsler, COO for Woodside Energy, contends that this will be common across the industry. “Collectively, we all are subscribing to the lower-for-longer view on commodity pricing for oil, gas and LNG products,” he said. “Therefore, across the industry you are going to see operators and service providers working to drive efficiencies across the entire supply chain segment through 2016 and beyond.”

A key driver to efficiency will be standardization. The individual tailoring that the industry has seen historically comes with a high price tag, and companies are beginning to see the value in standardizing equipment and processes to bring down costs. Almost half (44 percent) of the upstream companies responding said they would increase standardization in 2016.

“Almost by definition, standardization will lead to cost efficiencies, as it is intended to reduce complexity, one of the biggest causes of cost creep,” said Martha Viteri, head of subsea and well systems unit, North America, at DNV GL. “By implementing standard processes, operations can be streamlined and made more predictable.”

The digital oilfield

Another potential contributor to improved efficiencies is digitalization—making use of the reams of data collected by instrumentation throughout oil and gas operations to optimize operations. DNV GL asserts that operational efficiency could be boosted by as much as 20 percent if the oil and gas industry could analyze and understand all the data it’s producing.

“The first winner with the implementation of digital technology is operational effectiveness, but, with it, comes improved efficiency, including energy efficiency,” said Christoph Frei, secretary general for the World Energy Council. “Shale is a great proof. Without embracing digitalization, we wouldn’t have shale today, as we wouldn’t have the sophisticated, directed and monitored technologies that made shale extraction possible.”

Shale exploration is an area of the industry most affected by low oil prices, making quicker drilling and well-completion times essential. In Texas's Eagle Ford region, rig efficiency is 18 times greater than it was in 2008, and 65 percent more than in 2013, DNV GL reports.

Although we’ve seen a lot of discussion about the digital oil field in recent years, the fact is that the oil and gas industry has not been a particularly fast adopter of digital technologies. Koheila Molazemi, service area director for global risk management advisory at DNV GL, expects that to change. “Although the oil and gas industry has not been very fast in deploying data-smart technology in the past, it is moving faster now, and there’ll be more changes in the coming two or three years,” she said. “In 2016, implementation will probably be on a smaller scale, with companies looking at how they can deploy data-smart technology to gain efficiencies and better performance in terms of operations and safety. This would lead to cost savings. It is the beginning of a longer-term shift.”

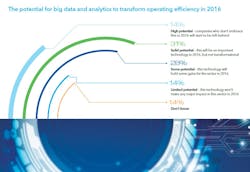

Still, survey respondents were split on the expected effect of digitalization on the oil and gas industry in 2016: 45 percent said digitalization had high or solid potential to transform operating efficiency this year; 41 percent said it holds some or limited potential.

Challenges to digitalization include deciding which areas to prioritize, a lack of resources and experience, and a concern about security issues. “Much of the data generated by oil and gas companies is business-sensitive, and operators demand uncompromising protection through rigorous security systems,” Molazemi commented. “You have to be able to prove that any data project takes the necessary steps to protect that data, and that robust and uncompromising security mechanisms are in place.”

Nonetheless, digitalization figured prominently among the key emerging technologies highlighted by survey respondents as having a significant impact on the oil and gas sector this year. Just behind unconventional gas extraction technologies (20 percent) were Big Data and analytics (16 percent), Internet of Things (IoT)/smart technology (15 percent) and digital oilfields (15 percent).

Let’s all work together

Certainly, the cost pressures that the oil and gas companies face are encouraging them to approach R&D and innovation with a more collaborative mindset. Asked about how they would maintain innovation in a climate of lower budgets, survey respondents pointed most often (45 percent) to increased collaboration with industry players.

The next two top responses on the list also emphasized the need to work together. Greater involvement in joint industry projects got a nod from 30 percent of respondents; 22 percent also cited creating a specific joint venture with an external partner as a priority. Further down the list, at 16 percent each, were greater partnering with academic institutions and greater partnering with innovative startup companies.

“There are a number of areas where our members are embarking on joint initiatives,” said Brian Sullivan, executive director at IPIECA, the global oil and gas industry association for environmental and social issues. “Overall, the industry definitely wants to increase the depth and extent to which they collaborate, particularly in areas where there are no competition issues.”

Carried out in late 2015 by Longitude Research on DNV GL’s behalf, the survey received responses from 921 oil and gas executives. More than a third were from oil and gas operators, and 60 percent from suppliers and service companies across the industry. The report, "A New Reality: The Outlook for the Oil and Gas Industry in 2016," includes comments from 12 in-depth interviews with experts, business leaders and analysts.