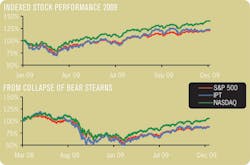

Public equity markets collapsed in the third and fourth quarters of 2008 and continued to decline through most of the first quarter of 2009, bottoming out in the first week of March.From that low, however, the rise was swift: our Industrial Production Technology, or IPT, index rose 72 percent from the low by year end, finishing up a remarkable 23 percent for the year. While seemingly impressive, that rebound underperformed other sectors, such as SaaS (or software-as-a-service), with a 131 percent rebound; or traditional software, with an 83 percent rebound; or even the entire Nasdaq Composite Index, which, in aggregate, rebounded 76 percent. The IPT did beat the Standard & Poor’s 500 Index, however, both in rebound (at 65 percent) and for the year (at 21 percent) and, in fact, generally tracked that broader market measure throughout the financial crisis and subsequent recession.The private, or mergers and acquisitions (M&A), market was similarly disrupted, but this impact manifested itself more through a lack of volume (e.g., transactions) than pricing variability. M&A simply does not happen when uncertainty rises too high, with that uncertainty being either performance or valuation driven. In 2009, both factors loomed large. Not surprisingly, completed M&A volume in the industrial automation universe fell precipitously in each of the first three quarters of 2009 before mildly rebounding in the fourth quarter. For the year 2009, completed M&A transactions in this sector were down an astonishing 43 percent. This compared with a 37 percent drop in overall M&A activity, similarly defined.Key observations for 2010Will the cost-cutting, personnel reductions and retrenching that automation vendors underwent in 2009 prevent their reacting aggressively to business opportunities expected in 2010? In particular, will certain key vendors such as Invensys Operations Management or Rockwell Automation be able to reposition their businesses to overcome perceived upheaval or poor performances in 2009?The rebound from the trough of a recession often realigns competition, as those who best managed the downturn are better positioned to profit from re-expansion, competitive and performance advantages, and weakened competitors. We would expect to see an increase in the level of acquisitions, as companies that either went too lean or otherwise fumbled during the recession are acquired by better-situated competitors with stronger balance sheets. Potential targets could include not only smaller, less known automation or related technology companies, but even some of the key integrated automation vendors. Price-to-earnings ratios, or PEs, sat in the mid-to-high twenties in 2006 and 2007 before crashing to low double-figures at the beginning of 2009 (our IPT index showed an aggregate PE of 11.7x in Q1 2009). As they rebounded by yearend (PE of 25x), can we say that equity markets have recovered for automation companies?Given the contrast with how the IPT has tracked from a valuation rather than performance perspective (as, for example, measured by cash flow generation), there appears to be a market perception or even expectation that the operating performance of industrial automation companies will improve, that traditional valuation benchmarking is relevant, and that, thus, value or prices will rise. Of course, the contrary could occur instead: Automation vendors fail to improve to prior performance levels, leading to deterioration in perceived appropriateness of traditional PEs in the sector—which would create a (second) value or price drop caused not by a future failure of performance but rather by a realignment of performance expectations.Alan Canzano, [email protected], is a Managing Director of Cronus Partners LLC, www.CronusPartners.com, an investment banking firm specializing in automation technology.Nothing contained in this article is to be considered the rendering of financial, investment or professional advice for specific circumstances. Readers are responsible for obtaining such advice from professional advisors and are encouraged to do so.

Subscribe to Automation World's RSS Feeds for Columns & Departments

About the Author

Sign up for our eNewsletters

Get the latest news and updates

Leaders relevant to this article: