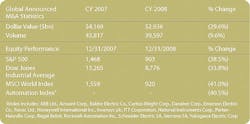

Ending with the large private-sector government bailout enacted on Oct. 3, the year was defined by turbulence and uncertainty, and marked the end of century-old financial institutions such as Bear Stearns, Lehman Brothers and Merrill Lynch. This turbulent period culminated in a dramatic drop in global equities markets, and merger and acquisition (M&A) activity toward the end of the year. As illustrated in the table, major world market indices declined by 41 percent in 2008, including a drop of 40.5 percent in the Houlihan Industrial Automation and Control Technology (IACT) Index. In the United States, the percent drop in both the Dow and the S&P indices in 2008 represent the single largest declines in the U.S. equity market since the 1930s. The majority of this loss occurred in the month following the bankruptcy filing of Lehman Brothers. On Sept. 15, the morning of the bankruptcy filing, the Dow opened at 11,422 and by Oct. 10, less than 20 trading days later, the Dow closed at 8,451, a loss of more than 25 percent.Plunging marketsThe worldwide financial crisis, plunging stock markets and the lack of available credit had an inevitable impact on global deal making. Not surprisingly, global announced M&A dollar volume and number of transactions dropped significantly in 2008, declining 29.6 percent and 9.6 percent, respectively. Financial buyers, not corporate buyers, accounted for a disproportionate share of the decrease in M&A activity, with a 72 percent fall from 2007 levels. In addition, a record number, 1,100, of previously agreed deals were cancelled in 2008, vs. a little less than 800 the prior year. Few metrics are more indicative of the uncertainty and turmoil in deal making last year than this record number of terminated transactions.While most experts agree that our current recession began in late 2007/early 2008, the industrial automation and control sector saw strong operating performance through the year, with several players reporting organic growth rates in the mid- to high-single digits. Sectors of strength in 2008 were Oil and Gas, Refining, Utilities and Pharmaceutical, with manufacturers making above-average investments in industrial automation and controls.Fortunately, both the debt and equity markets attempted to stabilize at the close of the year. The three-month U.S. dollar London Interbank Offered Rate (LIBOR) has dropped sharply from its high of 4.8 percent to 1.4 percent, its lowest since 2004. Equities saw a successful Santa Claus Rally (defined as a rise in equities over the last five trading days of the year and the first two of the new one) of 7.4 percent in the S&P 500, the highest gain since 1932. We are still hearing a lot of “talk” about deals, but the traditional broad auction is just about dead. However, M&A continues to be the favored approach to supplementing growth in the Industrial sector. Focused buy-side activity is picking up as corporate buyers and financial investors look for ways to allocate the significant capital they accumulated at the height of the Bull market. To put this capital to work, buyers are now willing to entertain minority stake investment transactions. In addition, discussions of stock merger deals, which strive to help chief executive officers and owners build entities with greater scale, cost saving opportunities and product/channel synergies are increasing.So, we say goodbye to 2008 without any fanfare, and with hope that 2009 will be a stable year. Ten percent growth in 2009 is not expected in this environment, in which being flat is the new “20 percent up.” Stay tuned for more to come as these financial and operating marketplaces evolve.Jim Lavelle, [email protected], is Managing Director of the Industrial Technologies practice, and Eugene Bazemore, [email protected], is Senior Vice President of the Industrial Technologies practice of Houlihan Lokey. For more about Houlihan Lokey, visit www.HL.com.

About the Author

Jim Lavelle

Eugene Bazemore

Sign up for our eNewsletters

Get the latest news and updates

Leaders relevant to this article: