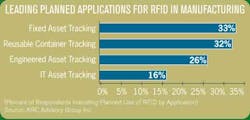

Tracking of mobile assets, such as forklift trucks or even handheld computers, is also of significant recent interest. Unlike the compliance-driven tracking of finished goods in an open-loop supply chain, clear business drivers are fueling the high level of interest in this application space.Improved asset utilization is the most obvious source of return on investment (ROI) for RFID-based asset tracking. Automated asset tracking systems improve asset visibility, thereby allowing manufacturers to quickly identify, locate and deploy capital assets, indirect materials and other asset categories. RFID-based asset tracking can optimize the availability of high-value assets, thereby reducing their Total Cost of Ownership (TCO). This is of particular interest when looking at high-value fixed assets that are depreciated, inventoried and/or stored. A key value proposition related to improved asset utilization and optimization is the reduced need for safety stocks, or not having to buy more of something simply because you can’t find what you have. This has been a particularly strong value proposition for asset tracking in the healthcare industry, where RFID-based systems have found early success.The ability of RFID-based asset tracking to enable process improvements is another area with significant value potential for manufacturers. Improved throughput or line speed typically leads the list of benefits in this area, with examples such as management of indirect materials where the RFID system can locate a tool critical to keeping an assembly line moving, rather than stopping the line or bypassing the station while the missing tool is sought. The issue here is whether bringing assets online more rapidly will enable faster throughput in your operation.As this last caveat suggests, the choice to pursue RFID-based asset tracking must be subject to the same ROI requirements as other applications. Consequently, growth in its deployment will be tempered by whether or not the asset is shared, whether its value exceeds a certain threshold, and the overall criticality of automated tracking, that is, whether misplaced assets are an issue or not. Conversely, some low-value assets are tagged just by virtue of their criticality in a manufacturing process for example, tools that are critical to line throughput. Convergence flashpoint ARC’s research into the use of RFID in manufacturing reveals that asset tracking is also the flashpoint where RFID technology convergence is at its greatest. We find that end-users may consider passive and active RFID, and/or Wireless Fidelity (Wi-Fi)-based solutions when evaluating technologies to use for asset tracking. This will lead to heightened competition among manufacturers, and ultimately, cost reductions, both of which are already evident in the marketplace.At the same time, suppliers are expanding the functionality of RFID tags in areas such as the ability to integrate environmental sensors and expanded onboard memory capacity, both of which can potentially improve ROI. In the Wi-Fi segment based on the Institutute of Electrical and Electronics Engineers 802.11 standard, for example, suppliers are integrating humidity, temperature and impact/shock sensors so the user can tell not only where the asset is located, but also what its environment is or was like.ARC recommends that manufacturers take advantage of the number of different technologies targeting this application space. The wide variety of RFID-based asset tracking solutions makes selection of the right technology even more important. Ability to operate in a metallic environment, read range, accuracy, noise immunity, memory capacity, read/write capability, ability to operate indoors or out, and ability to integrate with higher-level systems remain key criteria.

About the Author

Sign up for our eNewsletters

Get the latest news and updates

Leaders relevant to this article: