Manufacturers Move to Counter High Energy Costs

Higher fuel and energy costs have obvious direct and indirect impacts on the bottom lines of manufacturing companies. But many are fighting back with a range of actions designed to lower or offset those higher costs, while many too are adopting “green,” manufacturing practices that are not only friendly to the environment, but are also producing direct bottom-line benefits.

Results of a recent survey released by MFG.com (www.MFG.com), a global online marketplace for the manufacturing community, bears that out. More than 450 respondents from the MFG.com North American Buyer community completed the MFGWatch Survey covering energy-centric trends, with 88.2 percent of the participants from the United States and 11.8 percent from Canada. Participants included engineers, purchasing professionals, and operations managers who actively use MFG.com to source for manufacturing services, custom and standard parts.

In the survey, buyers were asked to describe their business’s response to the rising cost of fuel. Thirty percent stated they would raise prices to their customers, 29 percent would make savings or productivity gains in other areas, and 14 percent would absorb the cost and accept lower profitability. Twenty one percent responded that there would be no changes, while the remaining buyers would react by asking suppliers to charge less.

Changes planned

Buyers were asked what changes were planned to lower or offset fuel costs for their businesses:

• 28 percent of the participants are buying materials from suppliers closer to their facilities

• 25 percent are reviewing all transportation and logistics providers contract arrangements

• 22 percent are planning no changes

• 18 percent are changing their approach to production, e.g. moving from make-to-stock to make-to-order

• 7 percent are changing their warehousing, distribution and service center locations and/or strategies regarding supply chain network design.

In addition to transportation costs rising as a result of fuel price increases, buyers were asked to identify associated factors impacting their businesses:

• 42 percent of the participants had increased raw materials costs, e.g. oil derivatives such as plastics and chemicals

• 22 percent of buyers encountered increased costs for manufacturing processes requiring heating and cooling

• 12 percent of the respondents experienced reduced demand for their, or their customers’, products or services

• 9 percent of buyers had greater difficulty attracting and retaining staff

• 3 percent responded that they were losing sales to more energy-efficient competitors.

Going green

When asked if their company was actively pursuing green (environmentally friendly) manufacturing practices, 51 percent of the participants responded affirmatively, 36 percent stated that no changes were being made, and 12 percent did not know if their companies were pursuing green initiatives. The “yes” respondents were asked to describe the green initiatives they were currently practicing:

• 25 percent are recycling manufacturing waste

• 22 percent are reducing waste through more efficient manufacturing practices

• 17 percent have minimized power consumption through more efficient machine utilization

• 16 percent use recycled materials as a part of their raw materials

• 16 percent use green materials (wood from managed forests, toxic-chemical free materials, bio-degradable materials and the like).

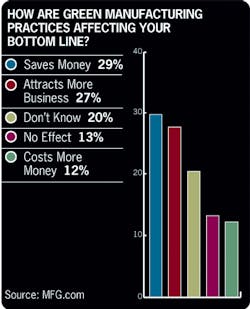

Buyers employing green manufacturing practices were also asked how it affected their bottom line:

• 29 percent stated Green practices saves them money

• 27 percent stated Green practices attracts more business

• 20 percent did not know if there was an effect on their bottom line

• 13 percent stated Green practices have no effect

• 12 percent responded that Green manufacturing practices cost them more money.

The MFGWatch survey also inquired if Buyers were developing new products to reduce their own fuel-related costs, such as reducing the size and weight of components and intermediate packaging. Sixty six percent of the participant responded No, while 28 percent stated they were developing new products. Six percent did not know if their companies were taking steps to develop new products.

MFG.com buyers were asked if they were developing new offerings that would enable their customers to reduce the fuel costs associated with using their products and services, e. g. more energy efficient. Thirty one percent of respondents stated they were developing new offerings, while 60 percent stated they were taking no steps in this direction.

More than $15 billion worth of manufactured goods have been sourced through MFG.com since 2000, with millions more sourced every day by 160,000 global members, the company says. Manufacturing buyers use MFG.com to source locally or around the globe for qualified suppliers of more than 300 manufacturing processes, including CNC machining, metal stamping, forging, plastic molding, metal fabrication, and metal casting.

MFG.com

www.MFG.com