China's Growth Propels DCS Market

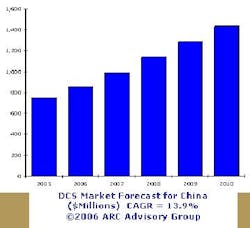

Last year marked another year of 10 percent gross domestic product (GDP) growth for China. Increased consumer demand and foreign direct investment continue to propel the growth of China's manufacturing industry. And according to a recent study from Dedham, Mass.-based ARC Advisory Group Inc., the distributed control system (DCS) market in China is expected to expand at a compound average growth rate (CAGR) of nearly 14 percent between 2005 and 2010.

"The substantial growth in grassroots construction of plants in the traditional heavy process industries, such as power, refining, oil and gas, and petrochemicals, is driving significant growth in the market for distributed control systems. Explosive growth is also expected in industries that have not yet adopted more advanced forms of automation including pharmaceuticals, food & beverage, and water & wastewater," according to the report, “Distributed Control System China Outlook Study,” authored by ARC Research Director Larry O'Brien and Senior Analyst S. R. Venkatapathy.

Power driver

China’s need for power is driving the need for automation in that industry. Power generation is currently the largest consumer of DCSs in China, and this market is going to grow significantly through the next five years, ARC says. China's power industry is divided between large-scale turnkey facilities serviced by total solution providers and smaller scale facilities. The adoption of advanced automation technologies in power generation, however, is limited when compared to other industries such as refining and petrochemical. Local Chinese suppliers are faring particularly well in this market as they are able to provide cost effective solutions that typically do not incorporate advanced automation functionality such as optimization, object-based systems, and sophisticated production management functions.

Also driving growth is China’s refining industry, which is struggling to meet increasing demand. No industry embodies the growth trends in the Chinese process industries better than refining, according ARC. China is currently the second largest oil consumer in the world and has big plans for expanding its refining capacity. Additions of 1.3 million barrels per day (bpd) are planned between 2006 and 2009. Unlike the power industry, refining projects typically incorporate the latest automation systems and technologies. This is due in part to China's desire to become a world-class industrial giant.

Fieldbus test bed

China is also becoming a global test bed for fieldbus applications, ARC points out. Adoption of the latest technologies among Chinese refiners is evidenced in the increased implementation of fieldbus technology. China currently has the two largest fieldbus installations in the world, Shanghai Secco and CSPC Nanhai. These plants employ advanced fieldbus applications, such as Proportional-Integral-Derivitive (PID) control at the field device level, plant asset management (PAM) software, and integrated safety instrumented systems (SIS). Expectations are that other grassroots refining projects will also implement the most advanced technology available, making the industry the world's biggest test bed of fieldbus technology.