HMI Market Set to Grow

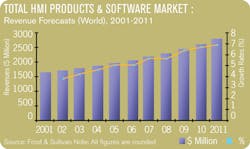

Prices in the HMI market across the world have been falling steadily, says the report, titled “World Human Machine Interface (HMI) Products and Software Markets.” Some price cuts have been a result of lower quality, lower priced imported products entering the market, while others are due to maturing market conditions. Despite lower prices, however, the study projects growth in the HMI market during the next several years, with revenues rising from $1.9 billion in 2004 to $2.8 billion in 2011.

“There is an increase in demand for Web-based HMIs, which offer reduced operating costs. On the other hand, it has created higher concerns over company security,” notes Frost & Sullivan Research Analyst Sanjeev Rajagopalan Sridharan. “The possibility of people accessing vital information and deliberately causing disruption and acts of terrorism raises the need to address the issue of security.”

Manufacturers of HMI must address the issue of security and provide potential customers with adequate precautionary measures, especially for Web-based systems, according to Frost & Sullivan. This can be done through infrastructure and access protection measures so that clients can invest in highly developed HMI solutions.

“End-user concerns of slow or flat growth in future years has resulted in limited investment in capital improvements,” says Sridharan. “Major end-users are still wary about the future of the economy, and large companies are not investing in upgrades or plant expansion.”

Owing to increasingly thin profit margins, manufacturers are finding it difficult to provide funds for research and development, and this is likely to hamper new product development in HMI technology in the long term, says the Frost & Sullivan study.

“Suppliers should offer broader product ranges and more integrated solutions in their products. This provides added functionality to end-users,” says Sridharan. “Such HMI products are likely to see higher sales.”