One big driver for that change is the recent introduction of new, integrated safety and control systems by major automation vendors, including Emerson Process Management, Austin, Texas, and Japan-based Yokogawa, says Goble, whose firm just completed a comprehensive report on the safety market.

In addition, the emergence of new, independent players is bringing an added competitive dimension to the safety systems marketplace, Goble indicates. As examples, he cites MTL Open Systems (MOST), with U.S. headquarters in League City, Texas, and RTP Corp., of Pompano Beach, Fla. Both have recently entered the market with certified systems for use in safety applications.

The September 2005 study from exida, titled “Safety and Critical Control Systems in Process and Machine Automation,” updates a 2001 study by exida, a German-based safety consulting and training firm. “We do one of these reports every three to five years, depending on market conditions,” Goble explains.

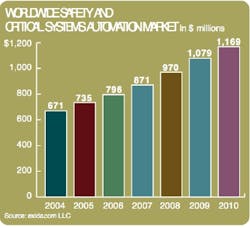

One factor prompting the current study was a notable upturn in the safety systems market beginning about a year ago, following a flat to low-growth period for much of 2003 and 2004, says Goble. The exida report projects that the worldwide safety automation market will grow at an average rate of 10 percent compounded annually over the next several years, rising from $735 million this year to $1.2 billion in 2010.

That’s much faster than the 3 percent average growth rate projected for the general automation market. Drivers for the rapid growth in the market for safety instrumented systems (SIS) include the high price of petrochemical products, the emergence of new functional safety requirements and increased recognition of the value of loss prevention, according to the exida study.

Goble notes that the emergence of more integrated safety and control systems is a continuation of a trend started several years ago when the first such systems were introduced. In the past, “a lot of strong safety advocates felt that you should never, ever have the same manufacturer for both your DCS (distributed control system) and your safety system, as a way to avoid common failures,” says Goble, “and there are still many people who believe that today.”

But new technology, combined with careful testing and certification by vendors to ensure an extremely low probability of any common failure, is leading to broader acceptance of integrated safety and control systems, says Goble. Vendors including ABB and Siemens brought out integrated systems several years ago, he notes. And within the past 12 months, both Emerson and Yokogawa have also rolled out new integrated DCS/SIS product offerings, he says. “So at this point, all of the major DCS players now have their own safety systems.”

The trend could lead to shifts in the market, as major DCS vendors that previously partnered with independent SIS suppliers in order to meet customer needs now move away from those alliances in favor of their own safety systems, Goble observes. This means that independent vendors such as Hima, and ICS Triplex, among others, “will have to feed on the market segment that still believes it’s essential to have different manufacturers for control and safety systems.” And that segment of the market appears to be declining, Goble says.

Nonetheless, “the other interesting thing is that there are now new independent players popping up for the first time in years,” Goble points out, citing MOST and RTP Corp. as examples. “So even the independent market is getting more competitive.”

Wes Iversen