Happy days are here again for the vendors of process automation equipment. It may not be the “jumping-up-and-down” kind of happy. But it is the kind of happy that comes from market revenues moving modestly upward at a seemingly sustainable pace, following a dismal industry performance early in the decade.

The latest support for that view comes in a new study from ARC Advisory Group Inc., Dedham, Mass. The report, titled “Total Automation Business for the Process Industries Worldwide Outlook,” projects 5.1 percent compound annual growth over the next five years for the global process automation market.

That trend represents a recovery from the down years of 2001 and 2002, when demand for process automation equipment hit the skids. The first signs of an up tick appeared in 2003, says Himanshu Shah, an ARC senior analyst and the study’s principal author. And the outlook for continued, though moderate, industry growth going forward should be inspiring to automation vendors, Shah says, because it comes in the face of continuing price declines for controllers, field devices and other factory gear.

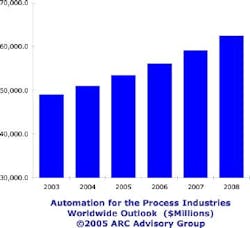

Indeed, the ARC study projects that while revenue growth will be modest for most product categories, unit growth will surge to much higher levels during the study period. In all, ARC sees the worldwide process automation market rising from nearly $50 billion in 2003 to more than $64 billion in 2008.

New dynamics

Besides a general worldwide economic recovery that is helping to drive market growth, Shah says a number of new dynamics are also at work. “We believe that all manufacturers are still very cautious with their capital equipment expenditures,” he observes, “but we also see several factors that are going to push growth.”

One factor relates to intense global competition, which ARC believes will compel most manufacturers to improve their plant machinery and processes in order to keep up with or stay ahead of the pack. Shah predicts broader application of Real-time Performance Management (RPM), for example, in which real-time data is collected from multiple plant sources and then organized for display to appropriate individuals to support smarter decision-making.

“Using RPM, companies are able to measure their performance in real time and then take steps to improve their operations,” Shah explains. “But this requires support from the capital equipment they employ. And while older capital equipment does not offer this support, the modern process automation equipment supports such initiatives,” Shah points out. This will help buttress sales of more new process automation systems and equipment in the years ahead, he predicts.

Also underpinning growth is the shift in the manufacturing base to low-cost global regions. ARC believes that general economic recovery will help drive reasonable revenue growth for process automation vendors in all five regions of the world. No region will manage double-digit growth, says Shah. But the highest growth rates will be seen in Asia. “China continues to be the primary growth driver for the market, but India is also providing increasingly bright prospects for suppliers, as users there continue to build new infrastructure, expand their manufacturing base, and modernize the many existing plants that have less sophisticated or limited automation,” says the study.

Blessing or curse?

ARC’s research also indicates that the proliferation of commercial-off-the-shelf (COTS) technology and other baseline technologies such as Microsoft operating systems has been both a blessing and a curse to manufacturing end users. “When process automation equipment employs COTS, it helps the users, because it does offer cost advantages and it raises their capability,” says Shah. But because life cycles of COTS technology are significantly shorter than those of traditional process automation equipment, it can drive a requirement for more frequent equipment upgrades, while also complicating migration issues, he explains.

The ARC study says that much of the growth in the process automation market today is coming from services. Because users have drastically pared down their internal engineering staffs, they are looking outside for automation engineering support, and many are forming collaborative partnerships for these services with their process automation suppliers.

Other high growth areas include safety systems, as well as systems designed to support regulatory compliance, Shah observes. On an industry basis, the fastest growth currently is coming in pharmaceuticals, food and beverage, and water and wastewater, he adds.

About the Author

Wes Iversen

Managing Editor

Leaders relevant to this article: