All (is Mostly) Quiet on the Business Intelligence Front

In the first few years of this century, much of the enterprise software marketing focus that had been lavished on ERP and supply chain systems in the previous decade started shifting toward business intelligence software. This category of software was positioned as a means of parsing all the data in a manufacturer’s various systems—from the plant floor to the enterprise—and making sense of it all in a way that would empower better decision making.

What’s not to like about that?

Apparently, the manufacturing industry wasn’t quite as ready to jump on the business intelligence bandwagon as software developers had hoped. Maybe it was all the investments put into ERP, supply chain, and customer relationship management systems in the previous decades; or maybe it was the confusion over which type of dashboard system was really needed — after all, everything from SCADA to MES to business intelligence systems were pushing dashboard views; or maybe it was the expense involved to tie all the various systems together for a business intelligence system to work as advertised.

I’m basing my opinion on the lackluster uptake of business intelligence software by the manufacturing industry largely on two things: 1) I can count on one hand the business intelligence related success studies I have seen in the past decade; and 2) the very limited response received to a joint research project on business intelligence we recently conducted with ARC Advisory Group.

Most research surveys we conduct get hundreds of responses. For example, our recent industrial Ethernet survey received more than 600 responses. The business intelligence (BI) survey, however, drew less than 100 responses. Though the limited number of responses means that its implications can’t draw a definitive picture about BI software use in the manufacturing industries, it does point to some key trends.

Among those trends are:

* Visual data discovery/query tools will be getting the most business intelligence investment moving forward rather than interactive or static dashboard-based BI or static, text-based reports;

* Like many other areas of software, interest in cloud-based versions of BI are attracting more interest from manufacturers; and

* Providing mobile access to BI data is of increasing importance.

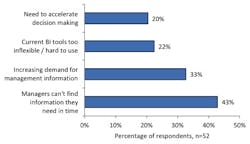

According to David White, senior analyst at ARC, the top driver of interest in business intelligence software for manufacturers is the fact managers aren’t always able to find the information they need in time to support their decisions. Survey respondents reported that managers were only able to find information when they needed it 61 percent of the time. Or, to put it another way, two out of five management decisions are not based on facts.

“This need for data, and to have it in a form that’s easy to access and comprehend, is what’s driving the 55 percent of survey respondents to report that they expect to invest in visual data/discovery analytics technology within the next 12 months,” white says. He adds that the richness of the data and ease of navigation available from visual analytics software can help to understand cause-and-effect relationships.

Mobile access to information also has a role to play in ensuring business users have access to information whenever they need it. “Only 23 percent of survey respondents currently have some mobile BI usage, but that is about to change, says White. “Thirty-one percent of survey respondents plan to roll out mobile business intelligence access within the next 12 months. This can be a particularly strong play for operational managers,” he says, “because operational managers may spend much of their time away from their desk, either in meetings or on the shop floor. As a result, pushing reports and dashboards to a desk somewhere is of limited use. Providing access to that information on a mobile device improves the chances that a manager will be able to access the information in time to support the decisions they need to make. It’s that simple.”

As for cloud-based business intelligence, the motivation for industrial users’ interest in this tends to center on cutting the time to deliver the application and bringing analytics to new user populations. Both of these approaches effectively outsource a significant part of the implementation work to the service provider, White says. For example, taking advantage of a cloud-based infrastructure for a new data warehouse can eliminate much of the time and cost required to procure, install and commission the various hardware and software components required.

For more information on this survey, visit: http://www.arcweb.com/strategy-reports/2014-09-04/whats-driving-industrial-investment-in-bi-and-analytics.aspx

About the Author

David Greenfield, editor in chief

Editor in Chief

Leaders relevant to this article: