Government regulations rarely translate into tremendous revenue growth in a global market. But this is not the case in the integral horsepower low-voltage (LV) motor market, where a regulatory push toward IE2 high-efficiency and IE3 premium-efficiency motors is signaling the imminent decline of the IE1 standard-efficiency market on a global scale.

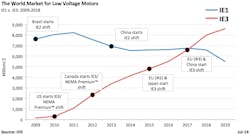

The IE1 market is still the largest regulated LV motor market in the world in terms of both revenues and units. But revenues for IE3 (and the equivalent NEMA Premium) are on course to almost double by 2018 to more than $8 billion globally.

The majority of the IE1 market is concentrated in Asia-Pacific and China, Eastern Europe, the Middle East, Africa, and the Russian Federation and CIS, where there are no energy efficiency regulations for LV motors. Major regions have been shifting out of the IE1 market since the U.S. began to in 2002, and this has catalyzed revenue growth in the form of more expensive IE2 and IE3 LV motors. However, because of exemptions in current regional regulations, IE1 and IE2 motors are still sold in significant quantities in the IE3 markets of North America well beyond their initial phase-out dates. The same is true for IE1 motors in the IE2-centric markets of Brazil, South Korea and Western Europe.

Typically, a regional transition to the next higher efficiency class of LV motor can take six years or more after the official start date has been announced, with the peak of the transition occurring in year three or four. Such is the case with the IE3 market. The U.S. and Canada are currently phasing out IE1 and IE2 motors, and the European Union, Japan and China will follow suit in 2015, late 2016 and 2017, respectively.

IE3 revenues have been growing at three-digit rates since 2010. The current IE3 markets are fortuitously located in regional markets that have been quick to recover from the global recession, and have not experienced further economic difficulties as seen in the IE2 markets of the European Union and Brazil over the past few years.

Additional new regulations have been finalized in the second half of 2014 by the U.S. Department of Energy (DOE) and in late 2013 by the European Commission’s updated ErP Directive (Article 1 of the EU MEPS), which are expected to address the lingering persistence of exempted lower-efficiency class motors in these two regions. Discussions were held in both regions in 2012 focusing on the best way to amend the existing regulations and close the unintended loopholes that are allowing these phased-out motor types to continue to be sold legally. Initially, the focus of the discussions was centered on increasing the horsepower/kilowatt range above the current power-rating ceiling of 500 hp/375 kW. However, the outcome of these discussions has been quite different.

The DOE’s solution involves the inclusion of more motor types, such as gear motors used in elevators and escalators, and vertical shaft pump motors used in water/wastewater and irrigation applications. The European Commission’s solution involves setting higher levels for ambient air temperature and operating elevation, and lower temperature ranges for water-cooled motors.

The new regulations will have a positive effect on revenue growth in both the IE2 and IE3 markets by requiring formerly low-cost/unregulated motor types to achieve a higher efficiency level. This provides justification for manufacturers to charge a higher selling price across some of their more specialized LV motor product lines.

The IE3 market is forecast to be almost equal in revenues to the outgoing IE1 market by 2017. It is interesting to note, however, that unit sales for IE1 are still predicted to be double the units in the IE3 market at that point. It is clear to see the revenue-enhancing effect of energy efficiency regulations that operate independently of the market’s demand.

According to forecasts, high-revenue growth in the IE3 market will begin to cool off significantly in North America just as it begins to heat up in the Eurozone, Japan and China, barring any further major economic downturns to these newest players in the IE3 market.

About the Author

Mark Meza

Principal Analyst

Leaders relevant to this article: