Two recent “benchmark” reports involving radio frequency identification (RFID) may help persuade remaining skeptics to begin looking at the technology, and also provide some guidance for its use.

According to a study by Boston-based research firm AberdeenGroup Inc., 60 percent of senior management participants say they are optimistic on finding value propositions for RFID within their organizations. Meanwhile, another report released by Odin technologies, Dulles, Va., aims to help companies make the right RFID choices.

The Odin report, titled “RFID Gen 2 Tag Benchmark,” was sponsored by Unisys, a Blue Bell, Pa., technology services company, and presents analysis of eleven leading EPC, or electronic product code-compliant Gen 2, or second generation, RFID tags. The benchmark was developed to provide end users with objective insight into how well tags actually work in the field and what criteria should be evaluated when making tag selection, placement and orientation decisions, says Odin, which provides RFID testing and consulting.

Where’s the money?

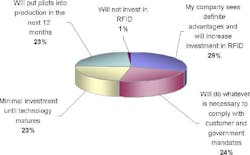

According to the AberdeenGroup study, titled, “The RFID Benchmark Report: Finding the Technology’s Tipping Point,” many companies—despite their long-term optimism—are still struggling with the RFID business case. More than 50 percent of survey participants have not yet identified RFID’s specific value proposition, while 48 percent of executives surveyed say their organizations are keeping their RFID projects in pilot stage because they are waiting for increased technology maturity.

At the same time though, AberdeenGroup found that companies are gearing up for RFID’s arrival. Seventy three percent of companies are building their internal RFID expertise, the report said. And within the next year, nearly half of all companies surveyed plan to spend 30 percent of their RFID-related budgets on external services and technology, a key technology maturity indicator, according to AberdeenGroup. Further, the number of companies that have no existing RFID pilots is expected to be halved during the next year.

Weak link

The Odin tag benchmark report may provide help to companies looking to wade into RFID. “Tag and reader communication is the first point of success or failure in any RFID system. The tag typically represents the weak link in the equation and must be selected with great care,” advises Patrick J. Sweeney II, Odin president and chief executive officer. Some tag manufacturers continue to outpace others in tag quality and versatility, according to Sweeney, who notes that these considerations should be central to end-user tagging strategies.

The Odin benchmark includes results of tag performance-testing related to distance, orientation sensitivity, material type, modulation depth and quality. The report looks at 11 different Gen 2 RFID tags from seven manufacturers—Alien, Avery Dennison, Impinj, Rafsec, RF IDentics, Symbol and Texas Instruments.

It’s a keeper

On a related, and perhaps telling, note regarding future industry expectations for RFID technology, Dallas-based Texas Instruments Inc. (TI) announced plans on Jan. 9 to sell its Sensors & Controls business to Bain Capital LLC, a Boston private equity investment firm. But in the first paragraph of the news release announcing the $3 billion deal, TI pointed out, “The sale will not include the RFID systems operations, which will remain part of Texas Instruments.”