Chinese Automation Increasingly Includes Networking Technologies

In a recent Automation World survey, 70 percent of respondents reported installing industrial fieldbus devices and systems in the past five years, while 86 percent reported installing industrial Ethernet-based devices and systems during the same timeframe. (“Fieldbus” encompasses legacy protocols like Profibus, Foundation Fieldbus and DeviceNet, while Ethernet protocols include EtherNet/IP, Profinet, Modbus TCP/IP and others.) Survey respondents were evenly split in their opinion of whether or not Ethernet will replace most fieldbus technologies, or if the two will continue to exist side by side for the foreseeable future. Now, a new report from analyst firm IHS, Inc. reveals insights into the use of industrial network technologies in China.

According to Alex Hong, IHS senior analyst for Industrial Automation – APAC, although the use of fieldbus in general is not as common in China as it is in developed countries such as Germany or the United States, the fieldbus technologies accounted for the bulk of new network nodes installed in 2012. But he predicts a migration to Ethernet technology as infrastructure improves and industries automate.

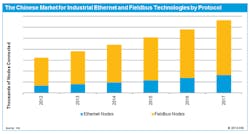

IHS estimates that the Chinese market for industrial Ethernet and fieldbus technologies combined grew by 18 million nodes in 2012, with about 15 million of those nodes using fieldbus technology. More than 3 million new nodes used Ethernet.

“In China, international brands are quite influential. This is also true for industrial networking protocols because most of them having their supporting companies,” says Hong. For example, the most popular fieldbus protocols in China are Profibus and CC-Link, which are developed and promoted by Siemens and Mitsubishi, respectively, which command large marketshare in China, he says.

“On the other hand, some open protocols also have a large number of nodes connected,” says Hong, “and the most representative ones are CANOpen, Modbus and HART. However, all three protocols don’t deliver strong functionality, and they are more likely to be used in low-end applications for easy connections.”

Most fieldbus protocols have Ethernet variants, so “many fieldbus users will turn to the Ethernet version of the application,” such as from Profibus to Profinet and from CC-Link to CC-Link IE, predicts Hong. New automation products will also support those new Ethernet connections.

Fieldbus is cost-effective

Andy Cheng, who heads up the global Industrial Ethernet business unit for industrial networking products maker Moxa, agrees. “Traditional PLC-based automation applications still use fieldbus because it’s more cost-effective in the case of Siemens solutions,” he says. However, “more and more customers use PC-based control, where industrial Ethernet is the de facto standard.”

(Research conducted by Automation World and sponsored by Moxa revealed that 72 percent of Industrial Ethernet applications were used at the machine level to connect devices and instrumentation. Forty-one percent of applications involved wireless Ethernet at the plant level.)

Infrastructure improvements are a priority in China, and that will help make Ethernet protocols more attractive. Hong says that availability of high-speed Ethernet “is quite considerable in China,” and Cheng notes Mitsubishi is adopting Gigabit Industrial Ethernet as the ccLink IE communication backbone. Moxa’s unmanaged Gigabit Ethernet switch is one of the certified communication devices supporting Gigabit Ethernet.

Hong predicts industrial customers will jump from old fieldbus technologies direct to Ethernet and says, “Actually, many of them are doing that right now.”

“With the upgrading of old facilities and the construction of new plants in China, customers are being compelled to upgrade their systems using Ethernet,” Hong adds. “We think it is a great opportunity for Chinese customers to upgrade their automation system under current market conditions.”

China is currently engaged in extensive upgrading and new infrastructure construction, and that will both enable and require a great deal of Ethernet applications. At a press conference in October 2012 regarding China’s industrial and communication sectors during the first three quarters of 2013, the country’s Ministry of Industry and Information Technology (MIIT) announced that the direct backbone network nodes would be increased “on the basis of the original ones—Beijing, Shanghai and Guangzhou. MIIT [also] has decided to include seven additional cities into the national direct backbone network nodes: Chengdu, Wuhan, Xi’an, Shenyang, Nanjing, Chongqing and Zhengzhou.”

Industry experts believe this upgrade will lead to higher communication quality and a far better direct backbone network. Analysts at IDC say the deployment of new backbone nodes will help boost information construction and IT investment growth in local areas, and “inevitably, this has far-reaching positive influence on datacenter siting, cloud computing layout, and even the development and landscape of the overall ICT [industrial communications and technology] industry.”