In an increasingly connected world, it’s perhaps not a surprise that the oil and gas industry is growing its number of device connections as well. But the industry—reaching into more remote and inaccessible locales—is relying in particular on wireless connections to transfer its machine-to-machine (M2M) data.

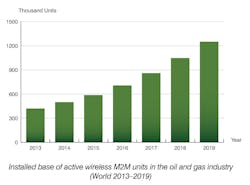

The number of devices connected by cellular or satellite communications in oil and gas application is expected to grow from an installed base of 0.5 million at the end of last year to 1.25 million by 2019, according to new research from Berg Insight. That’s a compound annual growth rate (CAGR) of 20.1 percent. By the end of the forecast period, cellular-connected devices are expected to reach 0.99 million, with satellite-connected devices at 0.27 million units.

Pipeline monitoring and tank monitoring are the top two M2M applications in the midstream and downstream segments, Berg Insight noted. Onshore well field equipment is the most common wireless application in the upstream segment. The growth of wireless M2M solutions in oil and gas has been driven primarily by safety and environmental concerns, regulatory compliance and demand for improved operational efficiency, analysts said.

Like many investments in oil and gas, however, wireless M2M has been hit by the drop in oil prices. “In 2014, M2M solutions in the oil and gas market experienced very healthy growth levels before slowing down at the end of the year when oil prices reached half of previous levels,” said Johan Svanberg, senior analyst at Berg Insight.

This is particularly true in North America, which leads the world in wireless M2M solutions for oil and gas. But the drop in prices has also led to an increased focus on cost savings and efficiency, Svanberg said, noting that new technologies that demonstrate high return on investment (ROI) are prioritized, especially when combined with solution-as-a-service (SaaS) business models that minimize the initial investment. Automation, remote control and monitoring are particularly important to make it cost-effective to extract, transport and distribute unconventional resources such as shale gas and tight oil.

Detailing the type of M2M providers active in the oil and gas industry, Berg Insight notes that Sierra Wireless, Digi International, Orbcomm and Numerex are major players that deliver solutions to a wide range of industries, including oil and gas. FreeWave Technologies sells M2M private radio solutions to the North American upstream and midstream oil and gas markets. Pason Systems and Zedi are Canadian companies that specialize in field instrumentation, equipment, services and M2M solutions for the upstream and midstream segments. CriticalControl, Elecsys, ZTR Control Systems, eLynx Technologies, Willowglen Systems, Oleumtech, AMCi Wireless, DataOnline and American Innovation provide specialized wireless M2M solutions for remote control, monitoring and automation in oil and gas. Tanklink, ISA, Sensile Technologies, Silentsoft, Powelectrics and Silicon Controls are major vendors of remote monitoring solutions for storage tanks in the downstream segment. Other important players are global technology and automation companies, including Emerson, Siemens, General Electric, Schneider Electric, Honeywell, ABB and Rockwell Automation.