What you measure is what you’ll get. This reliable adage holds quite a bit of truth, but not the entire picture. Yes, people work toward the metrics you set for them—that’s why it’s so important to set the appropriate ones—but reality is more complicated than that. Companies are increasingly interested in “managing by fact” and performance metrics are a great set of facts to drive decisions and action.

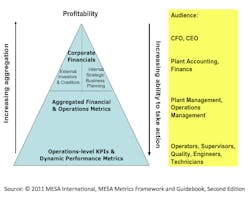

The complication comes from another fact: top-level business metrics are not highly actionable. That means they must connect down through plant- and line-level metrics so that people can take action. Each level—and each area within a level—needs relevant metrics. Even if what those detailed metrics are is obvious today, they will change. I guarantee it.

The key metrics

Some would argue there are the five primary key performance indicators (KPIs) for manufacturing operations that are also long-recognized: Total Cost, Total Cycle Time, Delivery Performance, Quality and Safety. The Automation World staff put the question to me: Are these five metrics are still considered primary KPIs across industry?

The short answer is yes;, these are important categories of performance metrics. In the MESA Metrics 2012 Study, Pursuit of Performance Excellence: Business Success through Effective Plant Operations Metrics, the most commonly used metrics involve cost, profitability, customer delivery performance, quality and safety. Cycle time popped up as the top metric for mixed-mode manufacturers, and as one of the top five operational metrics for discrete manufacturers.

In this research study, we used eight categories of metrics for production operations. Beyond quality, regulatory compliance (which includes safety), and customer responsiveness (which includes delivery performance), the study also looked at inventory, sustainability, asset performance, IT performance and flexibility. In certain industry segments and for certain business strategies, one of these may be as important or more important, but in general terms, manufacturers focused on the traditional five metrics areas will be gaining good direction.

Coming back to our five key metrics (Total Cost, Total Cycle Time, Delivery Performance, Quality and Safety), not all of these are at the same level. Some contribute to success in others. Think about how good quality and safety can contribute to lower costs, for example. In fact, in that MESA research I led, some of these metrics are categorized as business or financial metrics (cost and some elements of delivery performance), and others are categorized as operational metrics (cycle time, quality, safety and on-time delivery to commit).

Operations performance

Business leaders tend to look at financial metrics— cost, revenue, profit, earnings—and some of these rest pretty firmly on the production operations’ performance: manufacturing costs as a percentage of revenue; manufacturing costs per unit excluding materials; productivity (revenue or profit per employee or revenue per square foot); average unit contribution margin; and return on assets.

Yet no one, even those executives, can truly take action on those aggregate business metrics. That can occur only by focusing employees on the quality, safety, cycle time and other metrics that are drivers of those performance indicators. Figure 2 (“What Drives Certain Metrics”) shows the relationship between the aggregate or business KPIs and the performance drivers behind them. The drivers are like the levers you can move to change outcomes both at their level and for the indicators related to them.

Also, many of the metrics driving business performance have line-level metrics that drive them. These indicators may or may not be aggregate metrics, but it’s important to understand what drives performance to enable actions that result in real improvement to performance.

Specific automation technologies can typically play the strongest role in improving those line-level drivers. Examples include intelligent automation that can:

- Measure the cycle time of specific processes within a line or total time start to end in a line.

- Identify mini-stoppages in sub-processes that can add up to significant downtime, throughput problems, or quality issues.

- Sense or measure whether the product output is within quality parameters.

- Modify power sources and needs based on performance and current costs.

- Communicate with next steps in a process to accommodate specific conditions or issues from previous steps.

These may seem low-level and insignificant, but as Figure 2 illustrates, they actually drive performance results for the plant and the business. This is where metrics can have an enormous impact. Often, the need to improve performance drives investments in automation.

If an executive sees a need to improve customer satisfaction, for example, that can kick off an array of initiatives. These might include efforts to improve delivery predictability, and thus cycle time and equipment monitoring for added reliability; quality, and thus process consistency and control; or the ability to respond to new customer requests and thus programmable rather than hard automation that can both accommodate rapid changeovers and support new products, new parameters, and additional data collection and reporting.

Ideally, the control and plant engineering teams are involved in these continuous improvement efforts from the beginning. Having a deep knowledge of what current automation can provide is an important ingredient for performance improvement success.

Characteristics of good metrics

Many companies have a proliferation of metrics—hundreds of things are measured every day, on every line throughout the world. This can be confusing and challenging. Sometimes streamlining the set of metrics used is beneficial, but always the key is to focus on the metrics that are most likely to drive performance increases.

The MESA study separated out a group of companies that had improved their business performance most dramatically as “Business Movers.” This quarter of responding companies improved either dramatically on net operating profit or earnings, or broadly across many business improvement metrics.

These leading companies made these business gains by improving their operational driver metrics more dramatically. The study identified five characteristics of metrics that are used and improved on more widely by these business movers than others:

- Focus on forward-looking processes such as booked orders within schedule freeze period and planned vs. emergency maintenance work orders to be proactive

- Translate operating activities into financial terms such as cost of regulatory compliance

- Work closely with suppliers on their quality and delivery issues

- Use holistic metrics such as OEE that factor in multiple facets of performance

- Minimize non-value add time with metrics such as time for changeovers and resolve critical IT issues

To summarize, you will have many metrics, but those that appear to have the greatest impact on your ability to improve business results are that they are predictive, holistic, supplier-inclusive and time-oriented metrics, and communicate operations outcomes in financial terms.

Why is that last point important? Because you might spend all of your time on a line-level problem that occurs every 5 minutes but has no business impact, rather than a problem that occurs once every 6 months but damages the company’s cost, revenue or reputation outcomes severely enough that investors will notice.

Metrics processes

At the core of what business movers do differently is the process by which they set and measure their performance. This has been a consistent reality since the first MESA Metrics That Matter study in 2006. Some of the differences between those who improve the most and everyone else include:

- Speed of metrics processes – from data collection, to cleansing, analysis and display to appropriate personnel who can take action.

- Alignment of metrics from business and strategy, to plant operations, to specific line level metrics – the better you can align those, the more you can improve.

- Willingness to change metrics as conditions and strategies change.

- Consistency in displaying performance to line-level employees. Sounds basic, but most companies, even most business movers, cannot say they always provide metrics to operators and technicians so they can adjust.

- Automate processes to reduce procedural errors. While this is not a metrics process, automation professionals know that reducing variability can greatly improve productivity, quality, and reliability of every process being measured.

Based on the first and last process characteristics, speed of metrics processes and process automation, you might think that the continuous process industries would dominate the business mover category. Many of them have been well instrumented with fully automated data collection and largely hands-off production lines for some time. Continuous process businesses are actually the least likely to be business movers, but I believe that is because they made their whopping 10 percent gains in quality and process consistency long ago. Having optimized their processes in the past, they continue to improve, but not as rapidly.

Every industry has its particular pressures, and tends to focus on the metrics that represent that set of imperatives. For example, pharmaceutical and aerospace industries may have better developed cost of compliance metrics and practices than others. High volume manufacturers in consumer products, from autos to food, may have more experience with overall equipment effectiveness (OEE). Manufacturers in highly supply-dependent industries with outsourcing, such as electronics and automotive, are often better at measuring supplier quality and performance.

Continuous process industries typically have a better grasp of process capability, and can often tie line-level process performance to financial outcomes more directly. There are also software products for predictive performance measurement and improvement in some of the continuous process industries. These performance and optimization applications can totally change the economics of a facility that uses them. Because linkages between line-level activity and business performance are less direct in discrete and hybrid industries, different technology must come into play.

Evaluating your metrics

How do you know whether your metrics are good? It takes some analysis. And remember: the answer will change if your metrics do not. You need to focus on business needs, and craft metrics that flow down from those issues to your operational priorities to line-level issues. All of your metrics ideally should get regular reviews, at least annually and if your business conditions or products change frequently, perhaps even more often.

One of the most common issues companies have with performance measurement is that once a metric is in place, it often stays in place long past the point where it should be a priority. Some companies have suffered under a metrics regime that was put in place under a different strategy.

A common example is when a company moves from high volume to high mix. The metrics focus must move from efficiency and throughput to flexibility and speed to make changeovers. Otherwise, those in the plant are punished for decisions that are made in the executive boardroom.

In general, the broad categories of performance metrics have not changed much in many years. The details of what metrics you use, what their characteristics are, and how you gather and analyze the data for these metrics certainly should have changed—and should continue to change. What you do today is not likely to keep you ahead of the performance curve in the future. It’s a never-ending cycle of improvement and change that keeps a company ahead.

Julie Fraser is a leading industry researcher with a passion for manufacturing software solutions. Her company Iyno Advisors focuses on how to use software to improve outcomes for businesses, their employees, and the economy. She also acts as Outreach Director for the not-for-profit association MESA International. Reach Julie at [email protected]

About the Author

Leaders relevant to this article: