Industrial Sustainability Focuses on Energy Management

The topic of sustainability has been anything but static since 2016 when we last surveyed Automation World readers on the subject. From increased evidence of the impact of climate change and global demonstrations in favor of concerted actions to reduce harmful environmental practices to the Trump administration’s rollback of numerous environmental rules (http://awgo.to/UVHuh), quite a lot has happened in the past few years around sustainability.

Remarkably, however, not as much has changed from industry’s point of view. Yes, industry continues to focus on sustainability factors, but not much more than it did in 2016.

For example, in our surveys in 2016 and 2020, we asked readers if their companies have a sustainability program in effect. In 2016, 59.3% of respondents answered yes. In 2020, 58.8% also answered yes. These responses are within the range of statistical error, meaning that the level of sustainability programs appears to have remained static since 2016.

Vikram Mankar, principal digital product manager for GE Digital, said, “We are seeing different levels of maturity and awareness around production-related sustainability across the different manufacturing verticals. Consumer-oriented industries, like food and beverage and consumer packaged goods, are further ahead in sustainability programs, as compared to non-consumer and heavy-industry verticals.”

Given those vertical industrial qualifiers, Mankar agreed that the roughly 60% level of sustainability programs indicated by our survey response is a good approximation for manufacturing industries as a whole.

Luke Durcan, EcoStruxure director at Schneider Electric, noted that “there is still a misconception among some companies that sustainability is expensive or trendy, even though we know that neither is true. Sustainability can be a way to save money and spur innovation, and it is becoming deeply embedded in most organizations.”

He added that Schneider Electric’s own research into the topic has shown that more than 70% of the Fortune 100 companies now have either decarbonization or renewable energy targets. As a result, “companies without sustainability programs are starting to be seen as laggards, which impacts their reputation and ability to recruit and retain talent,” Durcan added.

Another reason the needle may not have moved much around sustainability since 2016 is that there are so many other investments industrial companies can make that have a much shorter-term return on investment (ROI), said Durcan. A company’s shareholders may not yet see the value in sustainability compared to other investment opportunities, he said. Durcan also noted that, for some companies, there remains a certain level of uncertainty as to where to start.

Key differences

Though the level of sustainability programs has not changed since 2016, some specific areas of focus have changed considerably, with a number of key areas of sustainability focus seeing decreases over the past few years.

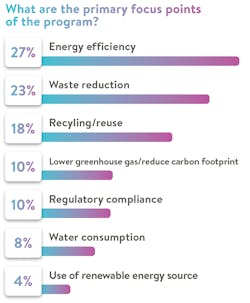

In 2016, 46.7% of respondents cited a focus on overall energy efficiency. In 2020, energy efficiency was cited as a key focus by just 26.7% of respondents. Likewise, recycling and reuse of materials was cited by 30.9% of respondents as being important in 2016, whereas in 2020 only 18.2% cited it as being key their sustainability efforts.

Durcan said that, in some cases, it’s not the cost factor that directs and/or inhibits sustainability efforts, but rather it’s the complexity and operational alignment of the company or facility. This means the insights of a sustainability initiative have to “be in the hands of those who can enact operational changes to drive efficiency,” he said. “There are some capital items that will drive efficiency, but without the data to know what processes consume what materials, when it happens, and for what outcomes, how do you know where to invest?”

To help answer this question, Durcan says Schneider Electric focuses on delivering “a resource map of the end user’s products through the entire production lifecycle to help make these kinds of judgements. Because products on the same production line may consume different resources, and different supply chains have very different carbon footprints.”

Another significant shift in survey responses was seen around the perceived success of corporate sustainability programs in industry. In 2016, only 37% considered their programs to be good or excellent. By 2020, that number had risen to 75.9%. In one sense, this is not too surprising considering that companies have had four years in which to improve these programs.

Interestingly, one area that remained unchanged between the two surveys was the focus on reduction of greenhouse gases and/or a company’s carbon footprint. This category was cited by 10% of respondents in 2016 and 2020.

Effects on automation spending

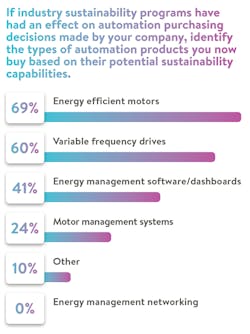

Some of the biggest changes we saw in the survey results came via the effects of corporate sustainability programs on specific automation purchases.

In 2016, 35.2% of respondents cited a focus on energy efficient motors, whereas, in 2020, 68.9% of respondents noted it. Variable frequency drives have also seen an uptick in interest, rising from 32.4% in 2016 to 60.2% in 2020.

Another big area of increase occurred around the use of energy management software. In 2016, just 19.5% of respondents cited it. In 2020, that number rose to 40.8%.

As industrial companies have matured in their understanding of production sustainability, Mankar said they have realized there are savings that can be achieved by making operational processes more efficient. “Plant personnel who decide on energy management software implementations are usually facilities teams who are not directly connected to production,” he explained. “The size of the production facility determines the need for sophisticated energy management. Investing in software and hardware like submeters and flow valves might be based on the budgets for the facility management department and the size of the facilities they manage.”

Referring again to the importance of understanding the entire production lifecycle to determine an effective sustainability program focus, Durcan said a manufacturing company doesn’t just need energy management software to understand per unit kilowatt energy use, but the data infrastructure that will deliver end-to-end supply chain carbon and resource loading. “That means integrating not only local and enterprise energy management, but also global supply chain data,” Durcan said. “This is a fundamental enterprise resource issue” not just a sustainability program issue.

Planning insights

New questions asked on the 2020 surveys explored that state of a company’s future plans around sustainability, implementation plans, and the effect of the Trump administration’s environmental regulations rollbacks.

In regard to the current administration’s rollback of existing environmental regulations, only 12.3% of respondents said these actions have had an effect on their sustainability programs. Of those who programs were affected by these rollbacks, reasons cited included:

• “Elimination of tax relief credits impacted savings from some projects”;

• “It’s tough to follow sustainability with mandates that run counter to [government] guidelines”; and

• “[The rollbacks have] caused a pause [in our sustainability program] to get full understanding of those rollbacks that affect us and we are making necessary changes to comply with the rollbacks.”

As for implementation strategies, responses indicated a fairly even split between plans to purchase new equipment or modify existing equipment to achieve sustainability program goals. Slightly more than 21% of respondents cited plans for equipment modification while 19.1% cited plans for new equipment/technology purchases.

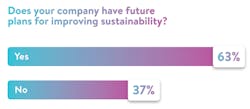

Despite the diverging approaches to sustainability across industries, the vast majority of respondents indicate the continuing development of new plans for their sustainability programs, with 63.3% of respondents confirming that new plans are in place. Among those with new plans, the principal areas of focus for those plans are on energy efficiency (34%), waste reduction (16%), and operations management (13%).

To achieve optimal savings from sustainability programs, there is “a level of investment needed to put in software tools that reliably allow for tracking sustainability progress,” said Mankar. “Most sustainability savings are achieved over a much longer term than expected. Therefore, there is resistance to invest in these efforts versus some other areas that may deliver a more immediate return.”

Mankar explained further that it’s sometimes necessary for companies to assign sustainability initiatives to facilities management or compliance and regulatory departments. However, these groups “might only look at a limited set of metrics that their departments measure and, therefore, might not have visibility at the line or production level. One of the biggest mistakes we have seen customers make is to start a sustainability initiative as part of a department initiative, typically environmental health and safety, which is separate from production. Often this ends up being disconnected from the actual production metrics and gets measured purely based on monthly utility savings. Then, when you just look at sustainability success as savings in utility bills, it does not seem like you have achieved much value for the effort you had to put in.”

To remedy this, Mankar said companies should focus on investing in “appropriate infrastructure to measure and connect sustainability impact with broader production operations. Sustainability programs need to be designed to address things beyond typical energy and utility objectives and look at other key aspects such as manufacturing waste, employee and community safety, material reusability, and overall operational efficiency.”

Durcan added that the biggest potential failure points of corporate sustainability programs tend be:

• Not having a cohesive strategy that can actually deliver business outcomes;

• Not understanding what data is needed to make decisions;

• Not knowing how to enact decisions to delivery outcomes and how they are incorporated into an operational system;

• Not clearly measuring the outcomes to define the business value and articulate ROI;

• Doing too much too quickly; and

• Not having sustainability identified as on operational outcome that is measured, enacted, and incentivized at the business unit level rather than at the corporate level.

Response factors

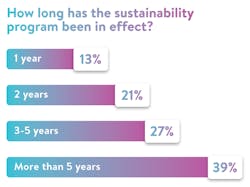

One factor that could account for some of the key differences between responses to the 2020 survey and the one conducted in 2016 is the age of sustainability efforts at the respondents’ companies. In 2016, 38.7% of respondents cited having sustainability programs in place for 5 years or less. Responses to the 2020 survey showed that 60.8% of respondents’ companies have had their sustainability programs in place for five years or less.

Mankar said that GE Digital has seen an uptick in sustainability efforts recently. “The focus has varied from energy efficiency and waste reduction to efficient operations scheduling,” he said. “The circular economy concept—an economic system aimed at eliminating waste and the continual use of resources—has also brought in new ideas around sustainability. Industrial companies are realizing the holistic aspect of sustainability and how aspects of production can contribute to the company’s overall sustainability goals and enable new benchmarks for throughput, quality, yield, and waste.”

Also, price points on almost all sustainable tech have fallen significantly to the point where return on investment is more easily achieved, thereby reducing risk, said Durcan.

Another consideration when comparing responses between these two surveys are the subscriber lists encouraged to participate in the survey and the levels of response among specific verticals. As with any media source, our subscriber lists change significantly over the years—and with all the change that has occurred in industry since 2016, that’s certainly no surprise. This means it’s unlikely that many of the people who took the survey in 2016 were also among the 2020 respondents.

Plus, there was a fair amount of variability in responses from specific industry verticals between the two surveys, which likely also had an impact on responses. For example, the top five verticals responding to the 2016 survey were automotive, food and beverage, OEMs (original equipment manufacturers), oil and gas, and power generation. In 2020, the top five were automotive, chemical, food and beverage, OEMs, and packaging, which tied for fifth place with the water/wastewater industry.

About the Author

David Greenfield, editor in chief

Editor in Chief

Leaders relevant to this article: