Greater amounts of automation may have reduced the need for manpower; conversely, maintenance costs and cost of ownership have increased. Ineffective maintenance accounts for $60 billion spent annually. In addition, manufacturers are under pressure to place more emphasis on safety and environmental impact.

The “if it isn’t broke, don’t fix it” approach to maintenance is a thing of the past. The increased amount and complexity of automation equipment currently in use in plants requires a higher order approach to maintenance. Maintenance costs are a significant component of total operating costs for all manufacturing plants, representing between 15 to 60 percent depending on the industry. A maintenance strategy should be driven by an organization’s overall business goals, and be properly aligned with the associated business strategy. This includes a clear understanding of the benefits and costs associated with the initiative, a cultural commitment to implementing the results, and a commitment to updating the program on a continual basis.

In asset management terms, “reliability” refers to the probability that an asset will function as intended, over a specified period of time, under a specified set of conditions. As a component of a comprehensive asset performance management (APM) strategy, reliability focuses on optimizing asset availability and utilization. Adhering to an asset performance management strategy can improve workforce and financial performance.

With a combined view of asset availability and other operational constraints, plant workers can make information-driven decisions. APM also provides key performance indicators (KPIs) for tracking the effectiveness of programs in concert with each other. In its simplest form, APM integrates and analyzes information from various reliability applications to provide a comprehensive view of asset reliability and enable reliability to be evaluated against a multitude of benchmarks.

ON THE WEB: White Paper – Wireless Condition Monitoring

New advancements in vibration monitoring and data analysis can lead to detections before costly shutdowns are needed. Visit bit.ly/awwp_043.

Reliability initiatives frequently require resource allocation or, at minimum, a re-allocation of financial, human and/or equipment resources. To gain the corporate level support required for such a substantial undertaking, ARC recommends developing a business case that outlines the objectives and resource requirements and quantifies the business benefits. Support from C-level executives is critical, since they both control the purse strings and have the authority to affect the organizational transformation required for a positive outcome.

Business case for reliability

Decision makers need to understand the impact of reliability on the bottom line. The business case should include a realistic assessment of current circumstances compared with the outlook on the enterprise post-implementation. It may be advisable to employ the services of an objective third party to perform the assessment and make recommendations based on industry best practices. Clearly defined strategic goals and the associated business risks and benefits should be presented in financial terms. Potential revenue growth from increased uptime and reduced maintenance, labor, inventory, energy and insurance costs that a reliability program can provide should be documented. The business case should also include the costs and risks of maintaining status quo. A documented business case also demonstrates belief that a reliability initiative will have a positive, measureable, and sustainable impact on business results.

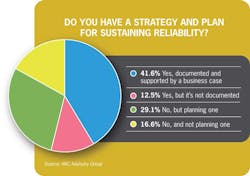

More than 40 percent of survey respondents indicated they had a strategy and plan for sustaining reliability at their facility supported by a documented business case. The minority reported their strategy was not documented, and thus less likely to produce the intended results. In ARC’s view, embarking on a reliability initiative without first examining the impact on all affected areas of the plant is a recipe for failure.

Paula Hollywood, [email protected], is Senior Analyst at ARC Advisory Group, Dedham, Mass.

About the Author

Leaders relevant to this article: