We’ve seen and heard about falling oil prices and how they could adversely affect not only the oil producers in the U.S. but also automation vendors in that space. But the flip side to that is how those lower oil prices are helping other manufacturers in the U.S., including the chemical industry. Given that more than 96 percent of all manufactured goods are touched by chemical products, that could have significant knock-on effects.

“The appreciation of the dollar, coupled with increased domestic supply of unconventional oil and gas, is helping to drive oil prices down,” said Kevin Swift, chief economist at the American Chemistry Council (ACC). “In turn, manufacturing costs are reduced, production is stimulated, inflation restrained, and consumer confidence, along with purchasing power and spending, is boosted.”

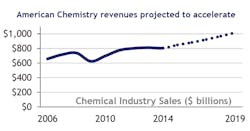

U.S. chemistry saw a 2.0 percent growth rate in 2014, and is expected to reach a 3.7 percent gain in 2015, then 3.9 percent in 2016, according to the Year End 2014 Chemical Industry Situation and Outlook published by ACC. U.S. chemical output is expected to continue to expand well into the second half of the decade.

“The wind is back in our sails,” Swift said. “During the second half of the decade, U.S. chemistry growth is expected to expand at a pace of more than 4 percent per year on average, exceeding that of the overall U.S. economy.”

Besides the help it’s getting by leveraging the cheaper oil supply, the chemical industry is also getting a boost from growth in key end-use markets, including light vehicles ($3,500 of chemistry per unit) and housing ($15,000 of chemistry per start). Light vehicle sales saw an increase of nearly 5.2 percent over 2013, and housing starts grew 7.5 percent between 2013 and 2014.

Though improvements in labor markets and growth in key end-use markets drove solid domestic demand for chemicals, weakness in external markets has limited U.S. chemical exports. Despite the competitive position American chemistry owes to a favorable oil-to-gas price ratio, trouble in the economies of major trading partners will delay another trade surplus until 2017. As new investments in the chemical industry come online, basic chemical export growth will accelerate, with an anticipated chemical trade surplus of $77 billion by 2019.

Basic chemicals were hardest hit from recessions in Japan and Brazil. Strong growth is now expected in inorganic chemicals, organic chemistry, plastic resins and synthetic rubber as most export markets revive. Inventories remained balanced in 2014, so any increased demand in 2015 will require new production, Swift explained.

U.S. chemical production grew across all major producing regions in 2014. The highest growth was seen in the Ohio Valley and the Northeast regions. As the surge of shale-driven chemical capacity starts to come online in 2017 and beyond, growth will continue to accelerate, particularly along the Gulf Coast. By 2019, American chemistry sales will exceed $1 trillion.

“This year’s gains were led by consumer chemistries and specialties, but advances in manufacturing and exports in 2015 will drive increased demand for basic chemicals, especially in those segments in which the U.S. enjoys a renewed competitive advantage,” he said.

More than 215 new chemical production projects valued at more than $135 billion have been announced in the U.S., Swift noted, helping capital spending surge nearly 12 percent in 2014 to more than $33 billion.

“We’re in the midst of an historic expansion, and the U.S. remains the most attractive place in the world to invest in chemical manufacturing,” said Cal Dooley, ACC’s president and CEO. “Looking forward, it’s critical that the new Congress pursues sound policies that ensure America stays ‘open for business’ to manufacturing.”

Chemistry is an $812 billion enterprise and one of the U.S.’s most significant manufacturing industries, accounting for more than 12 percent of all U.S. exports and 15 percent of the world’s chemicals.

About the Author

Aaron Hand

Editor-in-Chief, ProFood World

Leaders relevant to this article: