Economic Snapshot: Manufacturing Survey Points to Steady Growth

A charged audience attended the 2012 manufacturing summit in Rosemont this year—exactly one week after the U.S. Presidential elections—and saw the formal release of the 2012 Manufacturing and Distribution Monitor Report from McGladrey LLP (www.mcgladrey.com). In general, the survey's findings added more charge to the audience with "an overwhelming majority—78 percent—of participants experiencing an increase in year-over-year U.S. sales and expecting to see it again next year. However, executives feel the pull of Europe's dour economic situation and the survey points to "only 53 percent of businesses expect to increase non-U.S. sales in the next twelve months."

The survey results were recorded in May and June of 2012, with 924 middle-market manufacturing and distributors responding to the online questionnaire. The respondents titles included CEO, President and owner (41%); CFO or Senior Finance Executive (38%); COO (5%); Chief Marketing Office (2%) and Other (12%).

The survey addressed many vital manufacturing issues, including growth forecasts, cost expectations, workforce, process improvement and information technology (IT). Regarding growth expectations, "most businesses reported that they were holding steady (56 percent) or, in fact, thriving (39 percent), with businesses in transportation, power and cleantech, food and beverage, biotech and life sciences, and automotive industries leading the way.

Optimism was a bit dampened in the room with talk of rising taxes and the fiscal cliff, but the survey pointed to a general consensus by businesses to invest in capital projects now. With business lines of credit available, "24 percent of respondents felt expanding existing facilities/warehouses were extremely important or important, while 20 percent agreed that building or acquiring new facilities/warehouses was extremely important or important. The survey also says, "the biggest capital expenditure targets in the next 12 months are information technology (IT) and equipment/machinery.

Donna Smith, exec. vp, Associated Banking, participated in the morning's panel discussion and says, "Added efficiency is the name of the game and manufacturers are seeing the benefit of an increased spend in IT." And, the survey also confirms this trend with manufacturers stating their number one strategy to combat rising costs and maintain profits is to find better operational efficiencies: 88 percent of surveyed manufacturers have implemented an efficiency program.

The panel discussion also touched upon tax strategies for the coming year, with S-Corporations and Limited Liability companies preparing for a minor increase in tax rates in 2013. David Sterling, a tax expert from McGladrey and Pullen, LLP, advised on deferring deductions until next year and to accelerate income for 2012. He also stated the Research & Development tax credit will happen in 2013.

IT Security

According to the survey, more than three-quarters of businesses report that their information/data is not a risk or a little risk. However, verbatims show IT concerns are rising to the surface, such as:

> "Existing ERP Software Systems is so old, it's no longer supported by the supplier. A planned upgrade is schedule for summer...if it crashes were dead."

> "No formal disaster recovery plan it place, but it's on the 2012 business plan."

> "That hackers will get information about our suppliers and processes that we have spent countless hours developing and refining."

> "Overall, I would like to feel there is not risk, but I don't think that is a true statement that anyone could make."

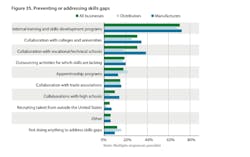

Another hot topic, workforce, was addressed in the morning's panel discussion and in its own brekout session. The report says, "Approimately 41 percent of businesses report that skilled talent is found only rarely or some of the time and companies manage this skills gap through internal training and development programs."

Hiring is also happening, with 67 percent of manufacturers expecting to increase emploment levels in the next twelve months, compared to 56 percent in 2011. Companies see costs going up for wages, benefits and other variable compensation; with the possibility of more money paid out in retirement benefits as an older workforce starts to retire.

About the Author

Grant Gerke

Digital Managing Editor

Leaders relevant to this article: