Auto Industry Trends: China Dominates World Vehicle Production

China will remain the primary driver of global production growth over the next four years, but the U.S. will remain the No. 2 vehicle producer in the world as North America continues to play a unique role in the automotive industry according to a new forecast from Penton's WardsAuto and AutomotiveCompass.

The report comes from the newly released joint Global Light Vehicle and Powertrain Forecast service from two respected sources of automotive data and analysis, WardsAuto and AutomotiveCompass. The new forecast also calls for auto makers to consolidate the number of platforms underpinning their vehicles while increasing the percentage of cars and trucks that rely on smaller engines.

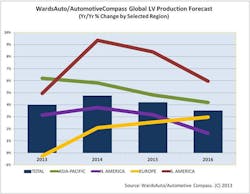

The WardsAuto /AutomotiveCompass forecast, which is updated monthly for clients, projects growth in all global regions through 2018, with total vehicle output increasing 23% over the next six years. The report highlights the China-led Asia-Pacific region's increasing dominance, especially through 2016, when production in China alone will climb to a stunning 26 million units. That's a 7.5 million unit increase from 2012.

By comparison, production in the U.S., the No. 2 vehicle producer, is projected to increase by 1.3 million by 2016, while production in the third-highest producing country, Japan, is forecast to decline by 875,000 units over the next four years, as capacity continues to shift to other locations.

In that same period, India will surge ahead of South Korea and Germany to rank fourth among vehicle producing countries. The WardsAuto/AutomotiveCompass outlook also projects that Volkswagen will lay claim to the top-produced platform in the world, by 2015, as its MQB architecture, which will spawn several small and midsize car and cross/utility vehicles, should end a three-year reign by Toyota's MC platform that began last year (when it usurped Hyundai's HD architecture) and is expected to continue through 2014.

The forecast also confirms the gradual trend of production consolidation among global platforms. In 2012, 31 platforms accounted for half of global production. In 2016, that number drops to 27.

The WardsAuto/AutomotiveCompass global powertrain forecast also shows the shift to smaller engines continuing as production of vehicles with engines of 4-cylinders or less rises from 82% of the total in 2012 to 85% in 2018. Ironically, as North America remains a bastion for larger engines, it will lead the growth of smaller engines. North American production of vehicles with engines of 4 cylinders or less increases from 47% of the region's total in 2012 to 55% in 2018.

The only automotive forecast created in the environment of a global newsgathering organization, the WardsAuto/AutomotiveCompass Global Light Vehicle and Powertrain Forecast brings together the collective insight, analytic experience and intelligence-gathering power of both companies, along with state-of-the-art database structure and coverage, proven forecasting and scenario planning tools and comprehensive reliable support.

Jim Bush, Managing Director of WardsAuto noted, "We are responding to client needs for better global automotive tracking and forecast solutions. The WardsAuto/AutomotiveCompass approach gives the client a better framework and the depth to understand and respond to changing conditions. Our combined automotive business intelligence solutions give our clients a better path to success in the global marketplace."

William Pochiluk, CEO of AutomotiveCompass added, "Global vehicle and powertrain development have accelerated. A global view of opportunities and risks requires new automation and integration tools, better databases and stronger support. The WardsAuto/AutomotiveCompass initiative provides the best database coverage at an extremely competitive price. "

The new WardsAuto/AutomotiveCompass Global Automotive Light Vehicle and Powertrain Forecast, covering over 98% of the global manufacturing base, is available immediately to subscribing clients. More information is available via the site: http://www.wardsauto.com/subscriptions/auto-forecasts