The Internet of Things (IoT) and sensors needed to enable it are receiving quite a bit of attention as manufacturing and industrial production turn to smarter devices and systems. The hype is real and not only for machine design; networks and systems are getting smarter. A recent report from GTM Research entitled “Transformer Monitoring Markets, 2013-2020: Technologies, Forecasts, and Leading Vendors” sees a huge opportunity for utilities to install “smarter” monitoring devices for critical transformers. The report also finds a solid return on investment (ROI) for the technology—a key aspect of the smart grid challenge.

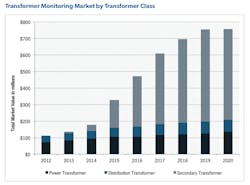

GTM Research defines the smart grid transformer market as a cocktail of monitors, sensors, software, diagnostics and analytics that promises to guard against outages and better protect utility grid assets. The report’s overall projection paints strong growth from the U.S. market for transformer monitoring hardware, increasing from its current valuation of $112 million annually to $755 million by 2020.

With an aging electric grid and soaring demands being placed on it—such as smart meters and distribution automation hardware—U.S. utilities have been scrambling to find cost-effective solutions and political will, in some cases, to implement a basic strategy.

“Utilities must invest in monitors, sensors and software for their new and aging transformers,” says Ben Kellison, smart grid analyst, GTM Research. They are the backbone of the U.S. alternating current grid, and they range from one of the most expensive utility assets to low-cost street corner devices manipulating power to ensure our toasters work properly.”

The report says that the “installation of the new and retrofitting of the old power, distribution and secondary transformers with additional sensors and monitoring equipment will take quite some time, as they are replaced gradually as they fail or are phased out due to perceived or verified insulation aging.”

“At GTM Research, we have seen the overall smart grid market slow down, but we see transformer monitoring and software markets as a high-growth area driven by the strength of the secondary transformer market,” adds Kellison. “Grid giants like ABB, Alstom, GE, Schneider Electric and S&C Electric have already caught on to the opportunity the transformer technology offers and are well-positioned to lead the market.”

According to GTM Research, transformer technologies are not typically rolled out in waves at utilities, but over the last few years notable exceptions have arisen in North America: San Diego Gas and Electric’s 2020 Reliability Plan, Arizona Public Service’s TOAN program, American Electric Power’s adoption of ABB’s Asset Health Center Solution, and Toronto Hydro’s pilot secondary transformer monitoring program.

Instead, monitoring is generally added at the most critical or expensive assets or added into specifications during the acquisition of new transformers. GTM Research says the spread of field area networks, the demand for edge grid data and associated the time delay will create demand for monitors at the transformer level that will ramp up to exceed the traditional power transformer market by 2015.

About the Author

Grant Gerke

Digital Managing Editor

Leaders relevant to this article: