Most of the discussion surrounding the recent uptick in North American manufacturing activity comes from the perspective of manufacturers. But what about the companies, including those that are manufacturers, that purchase manufacturer’s goods? Wouldn’t an examination of how they’re faring give us a good idea of what to expect on the overall manufacturing front?

A recent survey conducted by MFG.com provides exactly that insight.

If you’re not aware of MFG.com, it is an online marketplace where buyers of made-to-order industrial goods create a request for quote (RFQ) complete with their engineering CAD files and technical specifications. The RFQs are matched to suppliers with the right equipment, expertise and capacity. Collaboration, quoting, due diligence, awarding of the order and tracking through delivery of the product takes place on the MFG.com platform. (Note: Mitch Free, chairman and CEO of MFG.com, who is well known for his opinions on manufacturing, will be speaking at The Automation Conference about “The Next Industrial Revolution” and its impact on manufacturing).

Given MFG.com’s access to the key purchasers of manufactured goods, they’re in a perfect spot to gather insight into what manufacturing’s biggest customers are thinking and doing. The company’s 2013 MFGWatch report comprises data gathered from North American sourcing professionals who have used the MFG.com marketplace. The survey focused on determining different sourcing patterns, as well as predicting 2013 manufacturing industry trends.

According to the MFGWatch report, a significant number of product development companies view 2013 as a growth year, as many expect to make investments in new technology and are planning to hire more workers. In fact, 76 percent of the respondents expect to spend the same or more on contract manufacturing services as they did in 2012.

Other key findings delivered via the survey include:

• More than 60 percent of respondents experienced an increase in sales in 2012. This number is up from 52 percent at the end of 2011. Of note, at the beginning of 2012, only 30 percent of MFG.com users expected to see an increase in sales in 2012.

• Fifty-one percent indicated that their supply base expanded in 2012. In 2011, only 30 percent of respondents reported an increase in suppliers (i.e., manufacturers). In addition, 80 percent of this year’s survey respondents say they expect to either maintain or expand their current supply base.

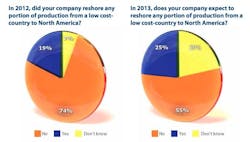

• “Reshoring is noticeable trend,” according to the MFGWatch report, “but not a strong enough trend to balance offshored production.” The report shows that 25 percent of U.S. companies intend to reshore production in 2013, compared to the 19 percent that intended to reshore in 2012.

• Eighty-four percent of respondents indicate that quality of products is the primary criteria for selecting a new supplier. Cost came in as the second most important factor, but the distance between the two—nearly 28 points—indicates the vital importance quality plays in consideration versus cost. In its report, MFG.com suggest that when this data is compared to the considerable number of respondents who indicate intent to reshore more operations in 2013, “it is clear that many companies are investigating supply chain alternatives that don’t require them to compromise on product quality in order to reduce costs.”

• In terms of export plans, MFG.com reports that, at the beginning of 2012, 26 percent of MFG.com users indicated they intended to increase their exports. 2013 projections predict a 5 percent increase in that number. Of potentially greater significance is that the percentage of respondents not considering exporting fell from 39 percent last year, to 31.2 percent. The MFGWatch report says, “These numbers suggest there is increased motivation to expand outside of the North American continental markets and an increased trust in the global economic recovery.”

About the Author

David Greenfield, editor in chief

Editor in Chief

Leaders relevant to this article: