Recovering Asian Manufacturing Sector Boosts Sales of Building Automation Equipment

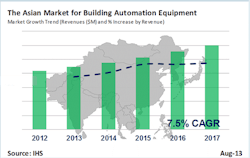

The Asian market for building automation equipment will grow to more than $1 billion in 2015, according to a new study by IHS Inc. Growth is being driven by several key factors, including a recovering manufacturing industry; increasing urbanization in China, India, and Southeast Asia; and a growing commitment towards the use of green building solutions.

According to Sam Grinter, market analyst in the Building Technologies Group at IHS, “A key driver of growth has been the recovery of the global economy, which has stimulated the manufacturing industry in Asia. The Asian market for building automation equipment is forecast to grow by more than $400 million from 2012 to 2017.”

Investment by governments and corporations in construction projects is also increasing demand, said Grinter. Examples of construction projects include Terminal 3 at the Soekarno Hatta International Airport in Indonesia, the Anxi Cloud Computing Service Center in China, the Chongqing Automobile Factory in China and the Yongsan IBD Office Tower in South Korea.

“Currently, building automation systems in Asia are predominately installed in the largest buildings, such as airports, hospitals, and large multi-tenant commercial offices,” Grinter continued. “However, as the price of energy in Asia increases, and as governments implement tighter legislation and building standards, it is expected that building automation systems will increasingly be deployed in medium and smaller-sized buildings. This will greatly increase the demand for affordable building automation systems in Asia.”

IHS estimates that Johnson Controls, Siemens and Honeywell were among the largest Western building automation equipment manufacturers in Asia in 2012 in terms of revenue. However, local vendors, such as Azbil (formerly Yamatake), Supcon, and Tsinghua Tongfang, have been successful in previous years and are also well placed to take advantage of the forecast growth.

“Today the Asian market remains largely unconsolidated,” Grinter added. “However, it is anticipated that small- and medium-sized local manufacturers may be acquired as Western brands increasingly look to gain a foothold in this high growth market.”

About the Author

Renee Bassett

Managing Editor

Leaders relevant to this article: