MCAA Press Release on Market Trend and Forecast Information

2013 bookings in the process measurement and automation industry grew approximately 5.3% according to data reported to members of the Measurement, Control & Automation Association. The trade association for the process measurement and automation industry, MCAA has just released the first of several snapshots of the market performance from 2013 based on the data supplied by its members and other sources.

MCAA collects data from its member companies for a variety of reports. On a monthly basis, they collect Domestic and Direct Export bookings information for the US, Canada and Rest of World. Quarterly, the Association collects more detailed information by product category as well as by user industry. Bookings are also collected on a monthly basis from the distribution companies that are Channel Partner members of the Association. Data is reported in confidence and the Association takes great care to avoid individual data disclosures by using aggregated totals.

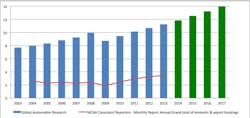

Looking at data from companies that participated in the bookings reports consistently over the past 10 years, MCAA notes that the industry has rebounded from its low in 2009 where bookings were down to pre-2004 levels and off 22% from the prior year. Over the four years since, bookings are up a total of 84%. 2013, however, represents the lowest growth rate of the four previous periods at just under $3.5 Billion. To make its comparison, MCAA used only data from companies who reported consistently over the 10-year period. Total actual bookings reported by all members participating in the bookings reports as of December 2013 was $5.4 Billion.

In addition to data that is published from the aggregation of member-contributed data, Global Automation Research prepares an annual forecast for MCAA looking out 5 years.

This graph shows the historical size of the industry as reported by Global Automation Research (blue) and the forecast going to 2017 (green). In RED is the actual reporting from 2004 through 2013 of a group of companies that have consistently reported to MCAA in the Monthly Bookings Reports. The actual dollar volume reporting for any one year would be higher than the totals shown here but the reporting base does change every year. In the Monthly Bookings Report all data is completely historical but that would not be representative going back this many years. MCAA reported only those companies which have reported since 2004 to show the MCAA trend as it stacks up against the actual results for the entire industry. The trend aligns perfectly.

It is the trend information that MCAA members rely upon when using the various data provided to them by their industry Association. According to Kathleen Spindler, Product Marketing Group Manager at Endress+Hauser in Greenwood, IN, “We know that the Association represents most of the major players in the industry, but we also know that it does not cover the entirety of the marketplace. What we care about are the trends—we can match our own performance against the trend line over time and analyze how we are tracking against the rest of the industry.” John Kronenberger Vice President of Finance & Operations for VEGA Americas in Cincinnati, OH, noted that “We review the data to benchmark our company performance in relation to others in our market space.” Of course, there are variations when a major company has a major booking but the overall trend, year over year, matches up quite well with actual performance. That positions MCAA to be able to offer forecast information to its members that is credible as well.

As mentioned, Global Automation Research provides an annual forecast for the Association members which looks at all of the US and Canada by both product categories and customer industries, provides some regional market potential information for both countries as well as a look at the key international trends that will affect the US marketplace. The 2014 Report will be available in May (free to all MCAA members; $2,500 to non-member companies).

ITR Economics also provides MCAA members with forecast information. In February and July, their Business Cycles Report looks at the key industries to which MCAA sells and predicts the 6-18 month outlook. MCAA member-contributed data is tracked against the US Industrial Production statistics as a confirmation of the value of the monthly and quarterly data gathered by the Association. Members also receive an Economic Forecast from ITR Senior Analyst D. Jeffrey Dietrich at its Industry Forum held in May and in a webinar held in November.

MCAA will be releasing more detailed information over the next several weeks looking at the breakdown of bookings information from its Monthly Bookings Report and from its Quarterly Product Report.

MCAA exists to help the management teams of process and factory automation product and solution providers run and grow successful businesses by offering timely, unique and highly specialized resources acquired from shared management benchmarks where proprietary company information is secure—like market trends from member-contributed bookings data.

>> For more information, click here