Robot Vendors Set Records in 2005

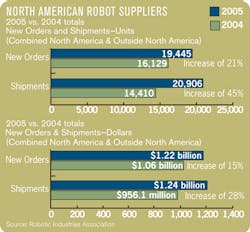

Robot shipments by North American suppliers totaled 20,906 units valued at $1.24 billion in 2005, the RIA said. That’s a whopping 45 percent gain in units and a 28 percent rise in dollars over 2004. New orders likewise set records, totaling 19,445 robots valued at $1.22 billion, gains of 21 percent in units and 15 percent in dollars over 2004.

Despite last year’s gains, however, the RIA is sounding a note of caution for 2006. It is gratifying for the industry to finally surpass the records set in 1999 when the economy was booming, noted RIA Executive Vice President Donald A. Vincent. And while the group expects that long-term growth will continue, the near-term holds several uncertainties, Vincent pointed out.

“Among our concerns is that in the fourth quarter of 2005, we witnessed a slowdown in year-on-year performance, as new orders in North America actually declined 2 percent from the same period in 2004,” Vincent said. “We’re also concerned about the troubles faced by leading companies in the automotive industry, since the automotive manufacturers and their suppliers are the largest users of robots in North America.”

According to RIA figures, automotive manufacturers increased their orders by 49 percent in 2005, while orders from automotive components companies jumped by 14 percent. Combined, these two sectors accounted for 70 percent of new robot orders in 2005. “Automotive purchasing tends to be cyclical, so we would not normally expect to see a repeat of this rapid growth in 2006,” Vincent observed.

Other concerns relate to globalization and economic conditions. “We remain concerned by the continued shift of manufacturing operations from North America to overseas countries such as China, as well as the robustness of the U.S. economy, which certainly is not as healthy as it was when we posted our previous record year in 1999,” Vincent said.

Long-term strength

Despite his caution about the near term, however, Vincent said that long-term growth for the industry will be fueled by a growing realization that robotics automation can help companies survive and prosper in an increasingly competitive global manufacturing environment. There are numerous recent examples of small, medium and large companies in non-automotive industries that are beginning to take advantage of the productivity, quality and flexibility gains that robots provide, Vincent said.

Robot use jumped by 30 percent in the life sciences, pharmaceutical and biomedical industries during 2005, for example. “As companies learn more about the benefits of robotics in industries where they may currently not be in widespread use, we can expect to see long-term growth,” Vincent concluded.