An Investment Firm’s View of Industrial Automation Spending Trends

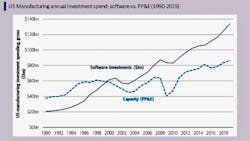

While there’s certainly no shortage of trend outlooks for manufacturing technology spending based on near-term plans, looking at where industrial companies have been investing offers interesting insights into where things could be headed.

Essentially, what researchers like Obin are seeing play out across industry underscores the trend seen in virtually every business sector—that software has become the predominant technology. Automation World discussed this trend with Michael Risse of data analytics software supplier Seeq in late 2019 for the article “Is Software Eating Industry Yet?”

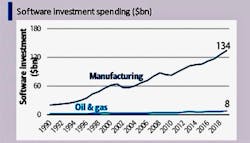

Diverging from the manufacturing industries’ overall spending on technology is the lack of spending on such technologies by the energy sector. Obin’s data shows that, in 2019, manufacturing as a whole spent $228 billion on plants and equipment, while oil and gas spent $174 billion. More striking was the disparity in software spending between manufacturing and the oil & gas sector. In 2019 the oil & gas sector spent $8 billion on software while the manufacturing industry spent $134 billion.

Read more about expected automation spending trends in Automation World’s feature article “Automation Expectations: Discrete Manufacturing.”

About the Author

David Greenfield, editor in chief

Editor in Chief

Leaders relevant to this article: